Jury decides document found in Aretha Franklin's home will serve as her will

Criminal defense attorney Lexie Rigden and Federal litigator Vik Bajaj joined 'Fox News @ Night' to discuss their take on the jury's decision.

Aretha Franklin, the Queen of Soul, passed away in 2018, but her estate is still in flux, pitting her sons against each other.

This week, a Michigan jury ruled that a handwritten document found in her couch after Franklin’s death is a valid will.

It is a victory for Kecalf Franklin and Edward Franklin, whose lawyers had argued that papers dated 2014 should override a 2010 will which was discovered around the same time in a locked cabinet at the Franklin’s home in suburban Detroit.

"I’m very, very happy. I just wanted my mother’s wishes to be adhered to," Kecalf Franklin said. "We just want to exhale right now. It’s been a long five years for my family, my children."

Franklin did not leave a formal, typewritten will when she died at 76.

The handwritten documents were found in a notebook in the couch after a search for records in the home by her niece.

Aretha Franklin performs during the 85th annual Christmas tree lighting at the New York Stock Exchange in New York. A Michigan jury recently determined that a handwritten document found in her couch from 2014 counts as a valid will, adding to the ongoing battle over her estate. (AP Photo/Mary Altaffer, File)

3 HANDWRITTEN WILLS FOUND IN ARETHA FRANKLIN’S HOME

On Tuesday, the jury voted the 2014 notes were valid, agreeing it was signed by Franklin, who put a smiley face in the letter "A" in her name.

There are differences between the 2010 and 2014 versions, though they both appear to indicate that Franklin’s four sons would share income from music and copyrights.

However, under the 2014 will, Kecalf and grandchildren would get his mother’s main home in Bloomfield Hills, which was valued at $1.1 million when she died but is worth much more today.

The older will said Kecalf and Edward "must take business classes and get a certificate or a degree" to benefit from the estate. That provision is not in the 2014 version.

The 2010 version of the will was favored by her other son Ted White II, and White’s attorney argued that it was more important than the ones found in the couch.

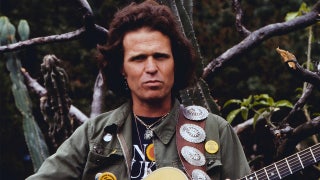

White, who played guitar with Aretha Franklin, testified against the 2014 will, saying his mother typically would get important documents done "conventionally and legally" and with assistance from an attorney.

American musician Aretha Franklin performs on stage at the Park West Auditorium, Chicago, Illinois, March 23, 1992. (Paul Natkin/Getty Images)

Now that the decision has been made on the will's validity, "the will will be probated, which is a court-supervised process of distributing assets according to the terms of the will," Rochelle H. Schultz, Estate Planning Attorney at Weinstock Manion, explained to Fox News Digital.

"The court will appoint an executor or personal representative of Ms. Franklin’s estate, who will be in charge of managing and distributing the estate according to the terms of the valid will. Ms. Franklin’s children still may disagree about who should be appointed as executor or personal representative and the terms of the will," Schultz added.

The battle over Franklin's estate is ongoing, but her family is far from the first to go to court over a celebrity’s will, or lack thereof.

ARETHA FRANKLIN'S ICONIC MOMENTS, FROM 'RESPECT' TO THE ROCK AND ROLL HALL OF FAME

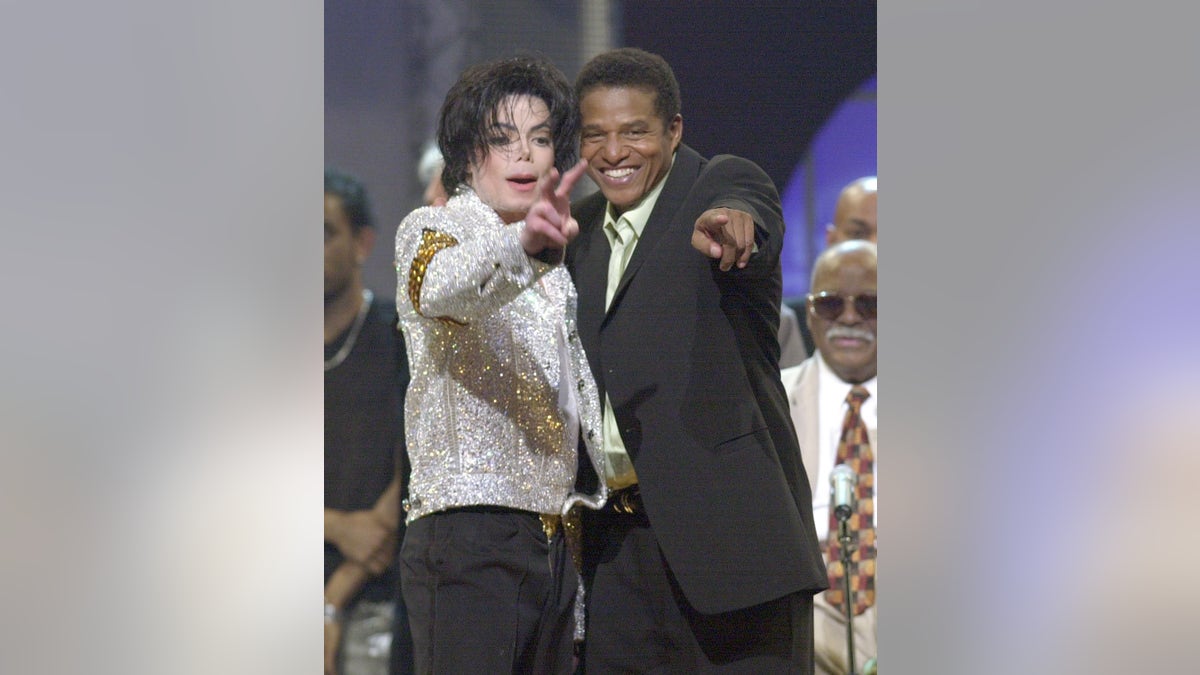

Michael Jackson

Michael Jackson died in 2009 with a will in place, but it was contested by various family members, including his father and siblings. (CARL DE SOUZA/AFP via Getty Images)

When Michael Jackson died in 2009, he left his estate to be administered in a trust by his mother, Katherine Jackson, and executors John Branca and John McClain, two long-time Jackson associates.

He also stipulated that his three children, Prince Michael, Paris, and Prince Michael II, then aged 12, 11, and 7 respectively, were to be raised by Katherine as well, and if she was unable to do so, he requested his longtime friend Diana Ross to take custody.

Noticeably left out of the will were Jackson’s siblings and father, Joe Jackson.

In 2009, Joe challenged the will and the executors of the estate, seeking an allowance to cover monthly expenses, but was denied by Judge Mitchell Beckloff in a Los Angeles Superior Court, according to USA Today.

"I don't think he gets to step into this and create further litigation," the judge declared. "Joe Jackson takes none of this estate. This is a decision his son made."

Michael Jackson did not name his father, Joe Jackson, in his will. Not long after his death, Joe attempted to contest the will but was denied. (Aaron Lambert-Pool/Getty Images)

MICHAEL JACKSON ESTATE SUES HBO OVER 'LEAVING NEVERLAND' DOCUMENTARY

In 2012, some of Jackson’s siblings, including Janet, Jermaine, Tito, Randy, and Rebbie, signed a letter accusing Branca and McClain of fraud and abusing Katherine.

E! News reported the letter read, "THIS HAS TO STOP NOW: NO MORE!!" According to Forbes, the siblings claimed that the will signed by Jackson on July 7, 2002, and filed in California was invalid because Jackson was in New York on the signing date.

According to Forbes, even if the will was incorrect, the court would revert to a previous version of the will, which didn’t include Joe. Also, under California law, the possibly wrong date does not automatically invalidate the will.

The outlet also reported that California Probate Code Section 8270 stipulates a period of 120 days to file a petition with the court to revoke the probate of the will, which had long passed by 2012 when the siblings went after Branca and McClain.

Not long after the initial letter, Jermaine withdrew his support from it and said in a statement obtained by the BBC, "After much soul-searching, it is clearly time for us to live by Michael's words about love not war."

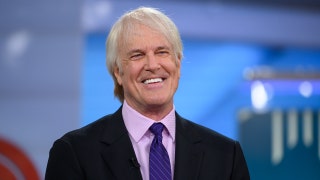

Michael Jackson, left, and Jermaine Jackson in 2001. Jermaine was initially one of the siblings who argued against the executors of Jackson's estate, but later withdrew his support. (Kevin Kane/WireImage)

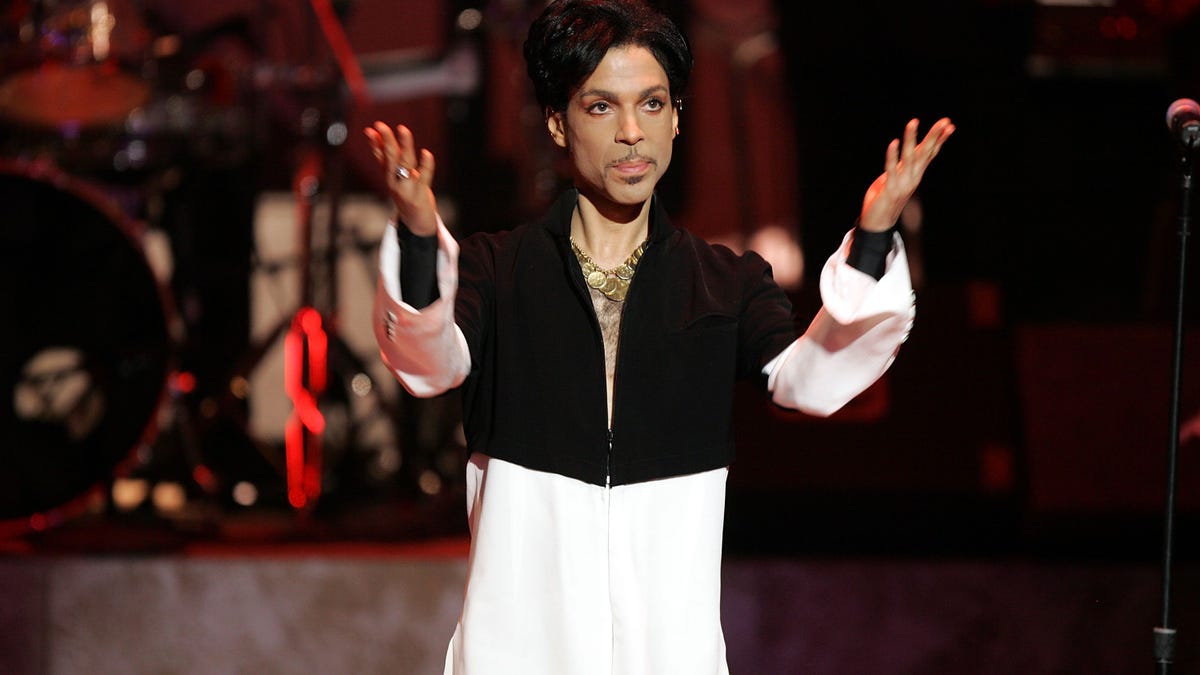

Prince

Prince died in 2016 without a will, causing a six-year-long battle over his estate. (Kevin Winter)

Jackson’s fellow music icon Prince died in 2016 without a will, leaving his $156 million estate in question.

With no spouse or children, his estate went to his six half-siblings, but there was no agreement on how to distribute it fairly, resulting in a multi-year court battle.

Three of the siblings sold their shares to Primary Wave, which bought the rights to Prince’s catalog in 2021, while the other three retained their portion and hired Prince’s advisors to manage them.

After six years back and forth in court, in 2022, a Minnesota judge ruled on the distribution of $6 million in cash plus other assets including the music rights.

Earlier that year, both camps of the heirs agreed to the $156 million final tax evaluation of the estate, and the heirs who did not sell to Primary Wave made their own LLC, Prince Legacy LLC, to limit tax exposure, according to Billboard.

In a statement to the outlet, a rep for Primary Wave said the company was "extremely pleased that the process of closing the Prince Estate has now been finalized."

L. Londell McMillan, one of the advisors working with the Prince Legacy LLC siblings, said in a statement to Billboard they were "relieved and thrilled to finally be done with the Probate Court system and bankers who do not know the music business and did not know Prince" and were looking forward to "implementing things the way Prince did."

It came as a surprise to many that Prince, who was known for strict control over his music, did not leave a will in the first place.

"Unfortunately, many people do not prepare an estate plan, including a Will, because they do not want to confront the fact that they will die one day or they have trouble deciding on how their assets should be divided upon their death," Schultz said. "Preparing an estate plan is often not the most urgent task for many people in our busy world so it does not get done."

Anna Nicole Smith

Anna Nicole Smith was in an ongoing battle over money with her ex-husband's family when she died in 2007. (Frank Micelotta)

Anna Nicole Smith had multiple ongoing legal battles at the time of her death in 2007, and they continued for years afterward.

Smith initially attempted to secure half the estate of her late husband, billionaire J. Howard Marshall, which he allegedly promised to her before his death. The couple was married for 13 months at the time of his death in 1995 at age 90.

She was initially denied, but after filings of bankruptcy on her part and a defamation claim against her from her stepson, the case became so complicated that it went to the Supreme Court in 2006, which ruled in favor of Smith’s claims against E. Pierce Marshall.

Shortly afterward, both Pierce and Smith died, and their estates went back at it, ending up in front of the Supreme Court again in 2011. This time, Smith’s estate was being represented by attorney Howard K. Stern on behalf of her sole heir, daughter Dannielynn Birkhead.

That was its own complication, because Stern, who was listed on Dannielynn’s birth certificate as her father, was being sued by Larry Birkhead, a former boyfriend of Smith’s, over her paternity.

Smith’s estate lost its second Supreme Court case in 2011, and an attempt to file a lawsuit seeking damages against Pierce’s estate in U.S. District Court was declined. Smith’s estate ultimately saw no financial payout from any of the Marshall family’s estate.

Stern was later found to have not been Dannielynn’s biological father; Birkhead was and eventually took custody of her.

Dannielynn Birkhead and her father Larry Birkhead attend the Kentucky Derby in 2023. Dannielynn was the subject of a paternity case shortly after she was born and her mother, Anna Nicole Smith, passed away. (Daniel Boczarski/Getty Images for Churchill Downs)

Sonny Bono

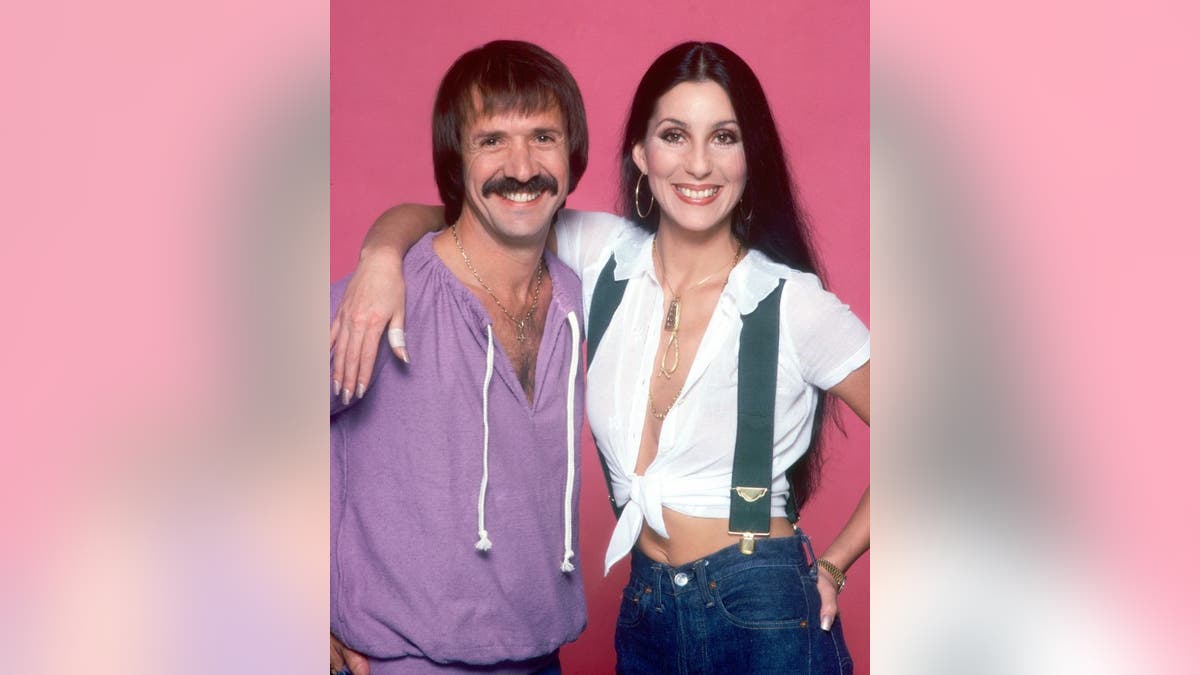

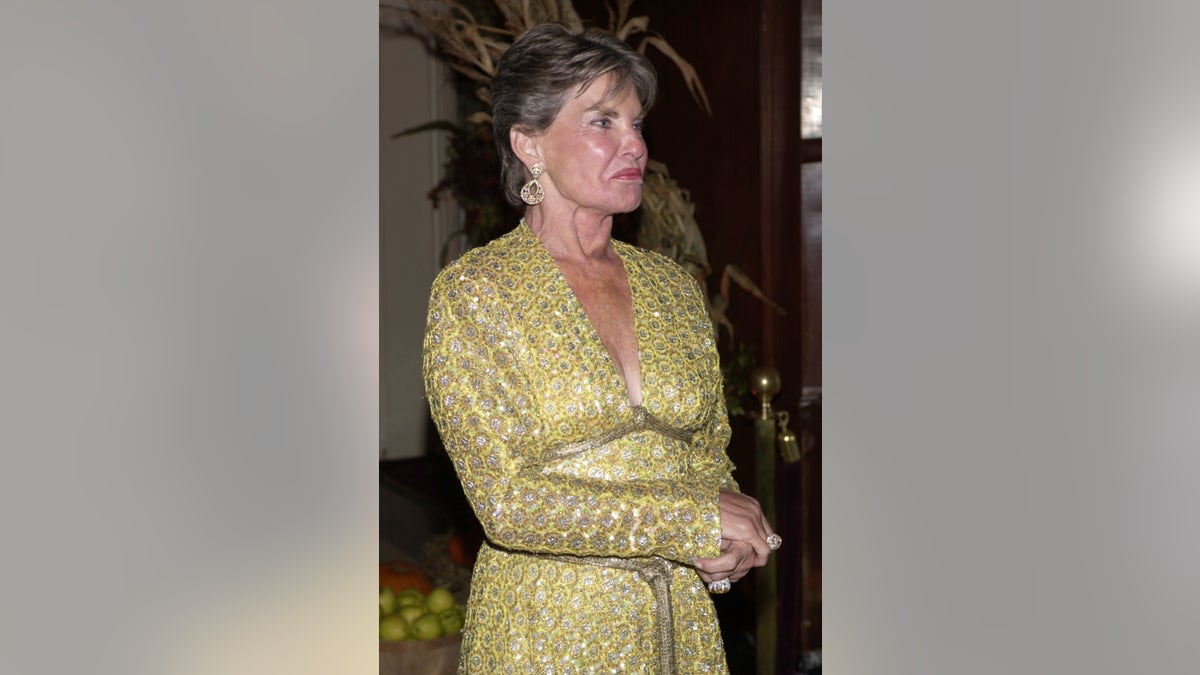

Mary Bono and Sonny Bono during 1989 Miss Hollywood Party at Chasen's in Los Angeles. (Jim Smeal/Ron Galella Collection via Getty Images)

Sonny Bono died in a tragic ski accident in 1998, long after his career as a singer and performer, and amid his successful political career.

The battle over his estate did not come until over 20 years after his death when his second wife and long-time musical partner, Cher, sued his widow, Mary Bono, over royalties to songs from their time as the duo of Sonny & Cher.

In 2021, according to the Los Angeles Times, Cher filed a $1 million lawsuit against Mary, the trustee of the Bono Collection Trust, as well as others involved in the estate, claiming breach of contract.

She claimed Mary tried to end provisions that entitle Cher to 50% ownership of the duo’s musical composition and record royalties, for their hits like "I Got You Babe" and "The Beat Goes On."

Documents obtained by Fox News Digital at the time cite a "1978 marriage settlement agreement" that Sonny and Cher entered into after their split. Cher claims the exes "agreed to equal division of their community property," and those were "irrevocably assigned" to her.

Cher poses and Sonny Bono for a photo session on July 22, 1977, in Los Angeles. (Harry Langdon/Getty Images)

According to the lawsuit, "in or about 2016 the Heirs, or a majority of them, with the assistance or participation of Wixen, issued a notice of termination to various music publishers or other companies to whom Sonny had granted a transfer or license of the renewal copyrights, or rights under them, in the Musical Compositions. The Heirs’ notice specified various effective dates of termination ranging from dates in 2018 to 2026."

They alleged the termination was done "without" Cher’s "knowledge or participation."

According to Reuters, Mary Bono later moved to dismiss the case, saying copyright law superseded Cher’s rights.

No final decision has been made at this time.

CHER CELEBRATES 77TH BIRTHDAY ON SOCIAL MEDIA QUESTIONING AGE: ‘WHEN WILL I FEEL OLD?’

Robin Williams

Robin Williams died in 2014 by suicide, and had a will in place, but his widow and his children became involved in a dispute over his personal items. (Peter Kramer)

Robin Williams' tragic death in 2014 led to a dispute between his widow, Susan Williams, and his children from his previous relationships, Zach, Cody, and Zelda, over the beloved actor’s personal belongings.

According to The Guardian, Williams’ trust granted his children his memorabilia and awards among other specified personal items.

The issue arose when Susan, who Williams said could continue to live in their shared San Francisco-area home, asked the court to exclude contents in the home, and claimed some items were taken without permission.

The outlet reported that in response, the children said Susan was "adding insult to a terrible injury" and keeping them from their father’s things, but her attorneys countered she was merely seeking clarification over the trust’s terms.

The issue was settled out of court, and both sides expressed satisfaction with the results of the decision.

ROBIN WILLIAMS' SON ZAK MARRIES ON WORLD MENTAL HEALTH DAY

Leona Helmsley

Leona Helmsley famously left $12 million in a trust for her dog, which was later adjusted by a judge. (RJ Capak/WireImage)

Leona Helmsley was famous for her big personality, dubbed the "Queen of Mean" during her 1989 tax evasion trial, and for her the multi-billion dollar estate going partially to her dog.

When Helmsley died in 2007, the bulk of her fortune went to the Leona M. and Harry B. Helmsley Charitable Trust, according to the New York Times.

Helmsley left trusts to benefit her brother, Alvin Rosenthal, and for two of her grandchildren, David and Walter Panzirer. The grandchildren were required to visit the grave of their father, Jay Panzirer, every year without fail or their claim to the trust would be terminated.

CLICK HERE TO SIGN UP FOR THE ENTERTAINMENT NEWSLETTER

She excluded her other two grandchildren, Craig and Meegan Panzirer, for "reasons which are known to them," according to the New York Times reporting.

A $12 million trust was left to her then 8-year-old white Maltese, Trouble, with the dog's care left to her brother.

Trouble lived in Florida, and in 2008 a judge reduced the dog’s trust down to $2 million, with the remaining $10 million going to Helmsley’s charitable trust, per NBC News.

CLICK HERE TO GET THE FOX NEWS APP

That charitable trust was also reported by The New York Times to have been focused on the care and welfare of dogs, but a 2010 ruling found that "the trustees may apply trust funds for such charitable purposes and in such amounts as they may, in their sole discretion, determine."

The Associated Press contributed to this report.