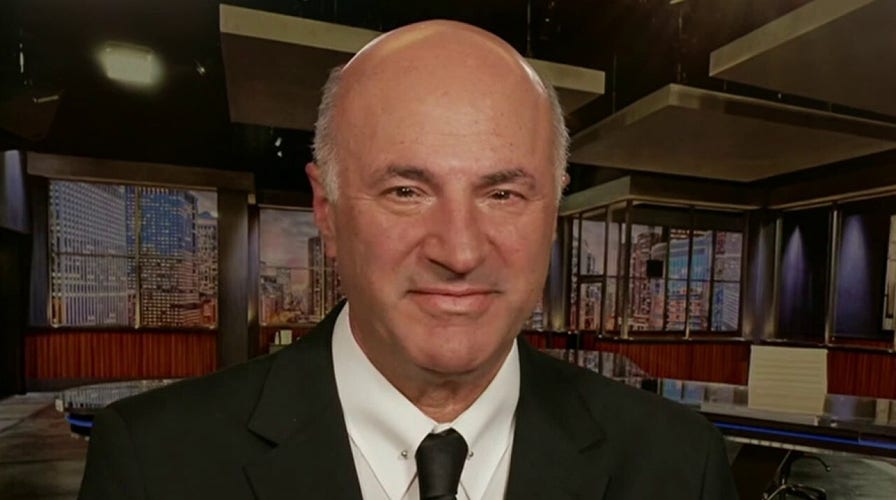

Kevin O'Leary blasts woke Silicon Valley Bank collapse, 'nationalization' of bank system

'Shark Tank' investor Kevin O'Leary sounds off on 'Hannity' on 'idiot' bankers at California boutique bank

Canadian-American investor Kevin O'Leary called out the "idiot bank managers" who led Silicon Valley Bank to its demise, further adding that the federal government's response to the collapse unwisely "nationalized" the banking system.

O'Leary, well-known by his "Mr. Wonderful" nickname coined on "Shark Tank" by fellow investor Barbara Corcoran, told "Hannity" that he however doesn't like playing politics, especially in terms of finance.

"When you're in my situation, you don't care that much about politics, you care about policy," he said.

"And so you make your decisions every day – my job is to get up in the morning and put millions of dollars to work. I really care about policy and what I see here, regardless of where you stand in politics -- it's a pretty bad policy."

SHARK TANK'S O'LEARY SLAMS BLUE-STATE REGULATION: MASSACHUSETTS IS AT WAR WITH ENTREPRENEURSHIP

Kevin O'Leary, chairman of O'shares ETFs for O'Leary Funds Management LP, (Ting Shen/Bloomberg via Getty Images)

While the FDIC (Federal Deposit Insurance Corporation) insures up to $250,000 per depositor per financial institution – leaving millions of bank deposits among the upper echelon depositor uninsured – O'Leary said the Biden administration's response to SVB's collapse seemed to negate that limit and make the American taxpayer the full and ultimate insurer.

"What we did, in my view, and it's a personal opinion, over the weekend, was to nationalize the American banking system," he said.

"We basically told everybody around the world, 'Regardless of who you are and what bank you're in, no matter how much you have, we guarantee it. We don't care who you are or why it's there. But no matter what happens, it's guaranteed'."

O'Leary warned a major unintended consequence of insuring nearly every bank deposit is that it will incentivize bank management to make even riskier investments in search of higher yields, because they will be compensated if they fail or make unwise decisions.

A customer stands outside a shuttered Silicon Valley Bank (SVB) headquarters on March 10, 2023 in Santa Clara, California (Justin Sullivan/Getty Images)

"I'd like to keep this very simple. I'm a bank manager in a bank today after this new policy decision, and I get compensated on the value of my bank's stock. You just told me I could take all the depositors' money, go to Las Vegas, put it on red," he said. "Maybe I double it. Maybe I lose it all. But it doesn't matter to me because you – the taxpayer and the government – guarantee all my depositors."

Host Sean Hannity did however question O'Leary over his own ventures' deposits in SVB, leading the investor to respond that he's a "big boy" and already diversifies his investments by-rule.

"If you have more than 250,000 in any institution, you're basically a hedge fund or a savvy investor or a business. You understand your risks and you act accordingly," he said.

O'Leary quipped that SVB is the "poster-boy for idiot management," calling the bank's brand now "radioactive waste."

"So at the end of the day, let this thing go under, because that's our democratic, capitalist system. Because when you're an idiot and it goes to zero, that's OK. Most of the people that had money, including me, above $250,000 in my portfolio of companies, we can take the hit."

In response to SVB's collapse, O'Leary advised his CEOs to deposit no more than 20% in any singular financial institution.

Hannity noted that Biden wasted no time assuring wealthy investors in a California bank they would be protected from loss, but still refuses to substantively aid the working-class residents of Columbiana County, Ohio and Beaver County, Pa., affected by the Feb. 3 Norfolk-Southern chemical train derailment disaster.

Hannity also noted that former Rep. Barney Frank, D-Mass., – a political player during the 2008 banking collapse – recently sat on the board of Signature Bank, a New York-based institution shut down by the state as Silicon Valley Bank collapsed.