NBC reporter declares plea deal a 'significant victory’ for Hunter Biden

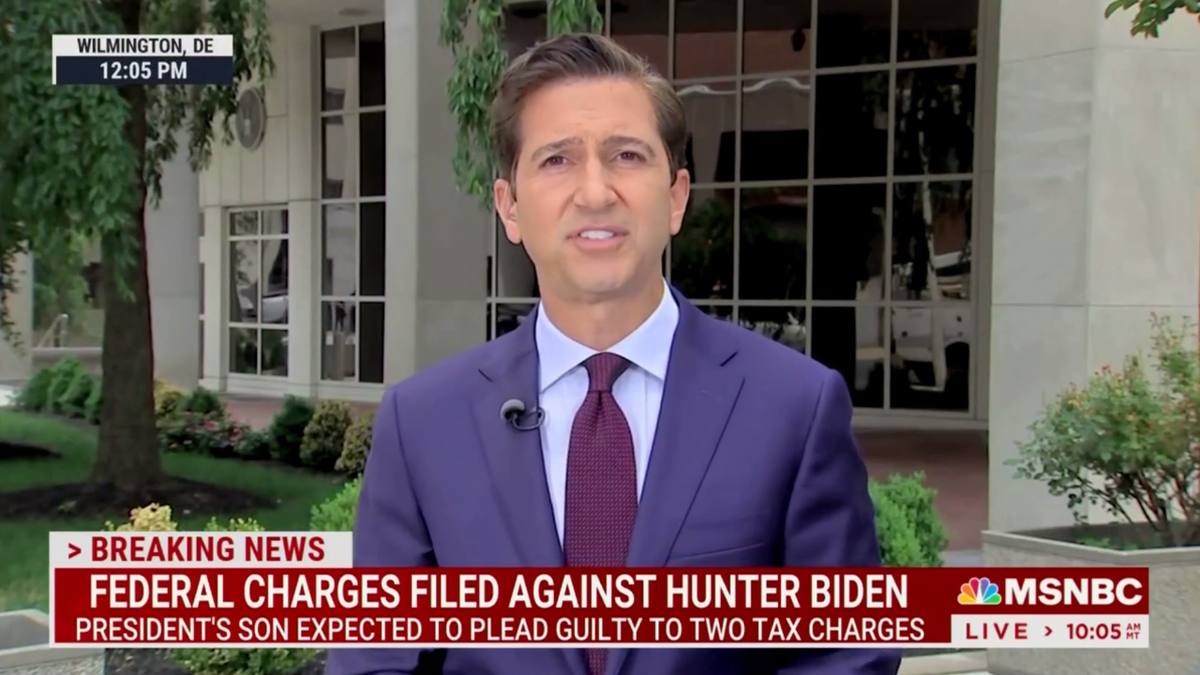

NBC News correspondent Ken Dilanian said that Hunter Biden's plea deal with the Justice Department over failure to pay federal income tax was a "victory."

NBC reporter Ken Dilanian claimed Tuesday that Hunter Biden’s plea deal with the Justice Department is a "significant victory" for President Joe Biden’s scandal-ridden son.

Fox News confirmed that the president's son will plead guilty to two counts of willful failure to pay federal income tax. Hunter Biden also agreed to enter into a pretrial diversion agreement regarding a separate charge of possession of a firearm by a person who is an unlawful user of or addicted to a controlled substance.

Dilanian reacted to the news on Tuesday. "In a sense, you see this as a significant victory for Hunter Biden," the reporter said on MSNBC after the news broke.

NBC reporter Ken Dilanian claimed that Hunter Biden’s plea deal with the Justice Department is a "significant victory" for President Biden’s scandal-ridden son. (MSNBC / Screenshot)

"Look, he paid back what we believe is more than $1 million in a tax bill last year. The documents don’t specify exactly how much taxes he owed," Dilanian conceded.

Hunter Biden, Dilanian added, was the subject of a "significant federal investigation that also looked into whether he was violating the law by representing foreign companies or governments."

The U.S. Attorney for the District of Delaware, David C. Weiss said that according to the tax information, Hunter Biden "received taxable income in excess of $1,500,000 annually in calendar years 2017 and 2018."

"Despite owing in excess of $100,000 in federal income taxes each year, he did not pay the income tax due for either year," Weiss' office said Tuesday. "According to the firearm Information, from on or about October 12, 2018, through October 23, 2018, Hunter Biden possessed a firearm despite knowing he was an unlawful user of and addicted to a controlled substance."

The U.S. Attorney for the District of Delaware David C. Weiss said, according to the tax information, Hunter Biden "received taxable income in excess of $1,500,000 annually in calendar years 2017 and 2018." (REUTERS/Elizabeth Frantz)

2011 EMAILS REVEAL HUNTER BIDEN HELPED BUSINESS ASSOCIATES GET ACESS TO VP BIDEN , TOP AIDE

Dilanian cited an NBC News report that Hunter Biden "was paid millions of dollars, some $13 million from Ukrainian and Chinese business interests." Despite that, he said, "at the end of the day, investigators did not find criminal wrongdoing" during their investigations.

Dilanian also responded to a line in the District Attorney's press statement which said that the case was "ongoing."

"We do have this puzzling line in the U.S. Attorney's news release that says the investigation is ongoing. But that could mean a lot of different things. It’s hard to imagine it still means there’s an investigation into Hunter Biden when he’s agreed to plead guilty to these charges," Dilanian said.

The White House also responded Tuesday to the news that Hunter Biden secured a tentative federal plea deal. (BRENDAN SMIALOWSKI/AFP via Getty Images)

The White House also responded Tuesday to the news that Hunter Biden secured a tentative federal plea deal.

"The President and first lady love their son and support him as he continues to rebuild his life. We will have no further comment," White House spokesperson Ian Sams said.

The Justice Department said Hunter Biden faces a maximum penalty of 12 months in prison on each of the tax charges — a total of two years — and a maximum penalty of 10 years in prison on the firearm charge, but the deal looks like it will keep him out of incarceration.

CLICK HERE TO GET THE FOX NEWS APP

Fox News’ Danielle Wallace, Rich Edson, Brooke Singman and David Spunt contributed to this report.