Judge Jeanine Pirro on FTX founder: 'The kid is a liar'

'The Five' co-hosts discuss FTX founder Sam Bankman-Fried donating to the Democratic Party and how that will be impacted by his company's downfall.

Judge Jeanine Pirro on Thursday railed against the fact that Democratic megadonor and "crypto-kid" Sam Bankman-Fried has yet to be extradited from the Bahamas to the United States amid questions about the fall of his cryptocurrency exchange company FTX.

Bankman-Fried, 30, remains holed up in the Bahamas after his $32 billion company went belly-up and over $1 billion in customer funds vanished last week. He became billionaire founding FTX. His penchant for philanthropy in the forms of donations to causes addressing issues like pandemics and climate change, as well as his massive donations to Democrats and liberal PACs, made him a major player in Washington and a media darling.

Now Bankman-Fried is facing investigations in multiple countries and his fortune has vanished. Pirro said the United States should have engaged immediately with Prime Minister Philip Davis' government in Nassau to extradite Bankman-Fried the 160 miles across the sea to in Miami.

"[Bankman-Fried] should have been extradited already. We have an extradition treaty with the Bahamas," she said on "The Five." "Lock him up."

PROMINENT DEM VOICES SUPPORT FOR BORDER WALL AS PHILA MAYOR KENNEY RAGES AT ABBOTT OVER BUSES

Investors sued the FTX whiz along with several public figures who openly pumped-up his business, such as "Seinfeld" creator Larry David and Tampa Bay Buccaneers quarterback Tom Brady. The Miami suit claims Bankman-Fried, Brady, David and others engaged in deceptive practices to sell FTX accounts, according to Reuters.

Pirro said some media coverage of the millennial billionaire has tried to paint him as "in over his head" or just a wealthy advocate of public service who got into a bad spot.

"[They say] he seems like a nice, enough smart kid who's got all the right things going on. The Washington Post is in tears: They're saying, oh my God, the guy was trying to prevent the next pandemic," she said. "So I look up how is he trying to prevent the next pandemic -- by supporting Democrats who say they want to prevent the next pandemic. It's like 80% of the money went to Democrats; i's not going to Republicans. They gave it to Republicans so they could say it was bipartisan."

PROMINENT DEM VOICES SUPPORT FOR BORDER WALL AS PHILA MAYOR KENNEY RAGES AT ABBOTT OVER BUSES

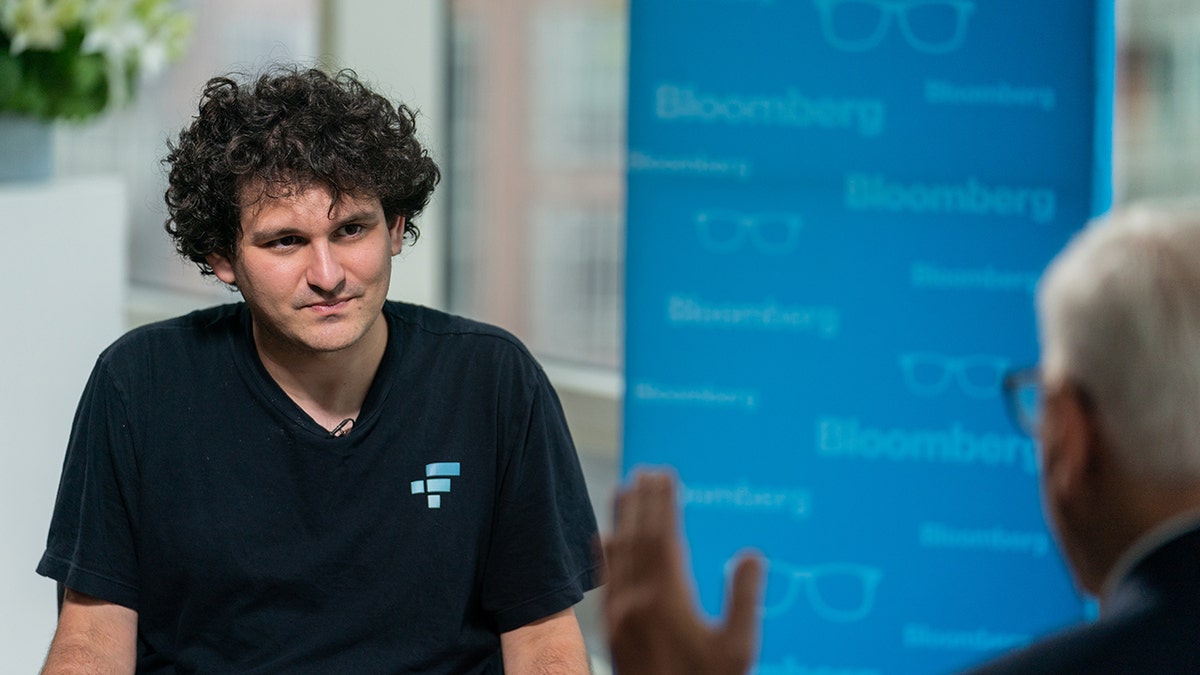

Sam Bankman-Fried, founder and chief executive officer of FTX Cryptocurrency Derivatives Exchange, during the Bloomberg Crypto Summit in New York, US (Jeenah Moon/Bloomberg via Getty Images)

"And let me tell you one more thing. The kid is a liar. He's a liar. He says he's a vegan and he looks like an ice cream advertisement."

SEXTON: PAUL PELOSI SAGA SHOWS NBC'S HYPOCRISY

"Five" co-host Jesse Watters agreed, saying Bankman-Fried piled money into Democratic senate campaigns just days before his crypto exchange imploded, saying essentially he "bought the Senate" for the left.

BIDEN'S CHINA DIPLOMACY ‘STRATEGIC INSANITY’ WITH REAL-WORLD REPERCUSSIONS: THIESSEN

Sam Bankman-Fried, founder and chief executive officer of FTX Cryptocurrency Derivatives Exchange (Jeenah Moon/Bloomberg via Getty Images)

Critics point to several close Senate races in Pennsylvania, Arizona, Nevada and New Hampshire that may or may not have been helped by money indirectly contributed by Bankman-Fried to larger Democratic contribution arms.

Watters said that if Bankman-Fried was a prolific Republican donor – only Hungarian-American financier George Soros donated more to the Democratic Party – the FBI would have "shackled" him already.

Bankman-Fried – the son of two Stanford Law professors – is "bigger than [Bernard] Madoff" and FTX's scandal is bigger than Enron, Watters argued.

In the 2001 Enron case, the now-defunct Texas commodity trader faced allegations of insider trading that later led to top executive Ken Lay being convicted of 10 securities fraud counts.

Lay however died of a heart attack before he could be sentenced, and Enron's accounting firm, Arthur Andersen, dissolved.