WATCH LIVE: Biden releases his budget, proposed tax hikes

The president delivers remarks on 'his plan to invest in America, reduce the deficit' and more.

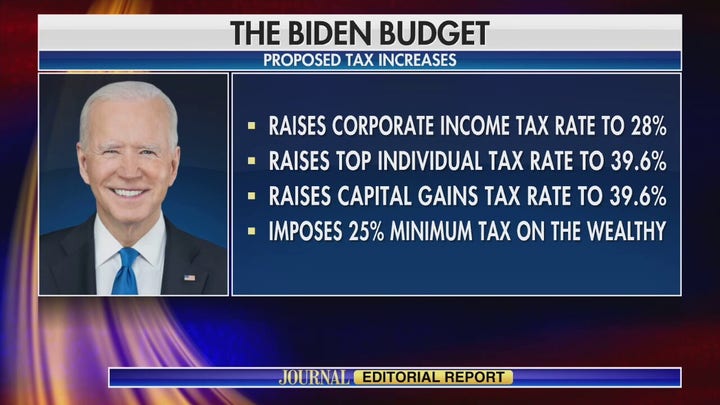

President Joe Biden recently released his budget proposal. The president is required by law to submit a request to Congress prior to the start of a new fiscal year. Ultimately, what’s passed will be dictated by Congress. The president’s budget request has become more of a wish list that plays a role in setting the temperature for the policy battles to come on Capitol Hill and in the regulatory agencies. Sadly, Biden’s budget contained a series of tax hikes that would batter the American economy.

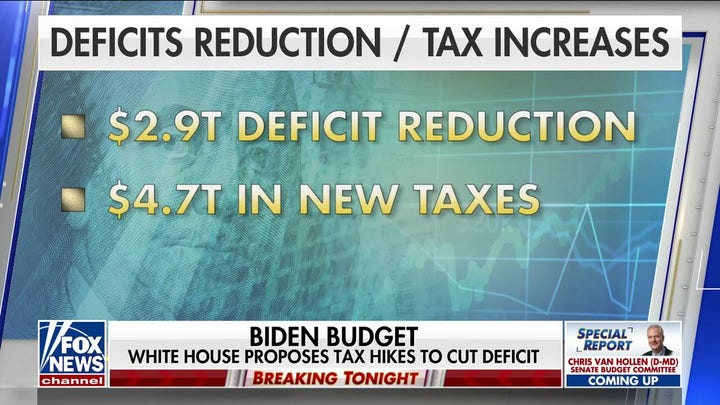

Biden defended his plan by claiming it would decrease the deficit by nearly $3 trillion over the next ten years. This is an apples to oranges comparison, making deficit reduction promises based on historic, COVID-related emergency spending. The budget never actually balances and deficits would begin to rise again, in both nominal terms and as a percentage of gross domestic product towards the end of the ten-year window. The savings numbers therefore mean very little.

Another disingenuous defense of the Biden budget has gained traction – the president’s claim that his corporate tax hike is in line with the policy from the Reagan administration. The president, in rolling out his plan, leaned into the microphone and whispered, "When we talk about corporate tax rate, Ronald Reagan was 28 percent [corporate] tax rate." He continued, sarcastically referring to Reagan as "that wacko liberal guy."

President Biden is indeed correct that the effective corporate tax rate for much of the Reagan presidency was 28 percent. In fact, the statutory rate was even higher than that, hovering around a staggering 50 percent before declining to just under 40 percent right before the end of Reagan’s second term. At first glance, Biden might appear to have a point in that his proposal is not terribly out of line with the historical corporate tax rates in American history.

BIDEN BUDGET WOULD LEAD TO ‘RECORD’ NATIONAL DEBT, WATCHDOG WARNS

However, this does not encapsulate the entire picture. The weighted average corporate tax rate for countries in the Organization for Economic Cooperation and Development (OECD) in 1986 – when the U.S. began to lower its rate from 50 percent to just under 40 percent – was roughly 48 percent. When the U.S. rate cut was complete, the OECD average had dropped to 45 percent. From there, the U.S. rate stayed steady at 39.1 percent until it was cut to 21 percent as part of the Tax Cuts and Jobs Act (TCJA) in 2021. By that time, the OECD average had dropped to around 25 percent.

It may be true that the raw numbers point to the Biden administration being relatively less inclined to corporate taxes than the supposed tax slasher, Ronald Reagan. However, the key difference lies in the fact that Reagan sought to bring the U.S. rate lower than the rest of the developed world at the time. On the other hand, Biden’s plan would reverse that trend, putting the U.S. above the OECD average for the first time since the TCJA was enacted under his predecessor.

There is a reason that the trajectory of corporate tax rates – both globally and domestically – has been pointed sharply downward for decades. Countries slowly begin to realize that lower and simpler taxes enable more innovation and economic activity. Corporate taxation is inefficient because much of the cost is immediately passed on to consumers through higher prices and workers through reduced wages and benefits. Other countries catch on and want to compete for innovation, economic activity, and prosperity. What ensues is a race to provide the most conducive environment for businesses to provide needed products and services to its citizens.

It would seem odd for a leader of a nation to understand that such global competition is occurring and deciding instead to make his nation less attractive to business opportunities. Unfortunately, that is exactly the path this administration is proposing to take the nation down on the other side of a global pandemic.

CLICK HERE TO GET THE OPINION NEWSLETTER

CLICK HERE TO GET THE FOX NEWS APP

One would think the Biden administration would have learned this lesson after the immense pushback it got when it tried to implement a global corporate minimum tax last year. Hungary outright blocked the agreement for a period, leading to the U.S. ending its tax treaty with the nation. Ireland also raised objections, as its low corporate tax rate attracts a lot of business that might otherwise headquarter elsewhere. The objectors finally relented, agreeing to a 15 percent rate. Confoundingly, Biden is pushing for a U.S. a rate nearly double that.

Businesses thrive when innovators get to keep more of their earnings to invest in the development of new and exciting products. That is why businesses are attracted to low-tax environments. Biden might try to fashion his tax regime as Reagan-esque, but the world has changed. If the U.S. insists on leaving its tax policy behind in the 1980s, the global economy might very well leave the U.S. behind in return.