‘The Five’: Liberal media in denial about the failure of 'Bidenomics'

‘The Five’ co-hosts discuss how Jillian Michaels ripped into Bill Maher for downplaying inflation on a recent podcast.

On a recent episode of his "Club Random" podcast, comedian and HBO’s "Real Time" host Bill Maher was talking to fitness guru Jillian Michaels about the economy, referencing a recent article and saying how America "won the pandemic economically."

While known for her fitness tips, Michaels held her own on the financial front – she was clearly exasperated by Maher’s take, lamenting inflation and the costs of everything from cars to houses to "bleeping" eggs.

It’s perhaps not entirely surprising that Maher would hold this view. The pandemic response produced a historic transfer of wealth from the middle and working class to the wealthy and well-connected.

President Biden speaks to reporters while departing at Des Moines International Airport in Iowa, April 12, 2022. (Reuters/Al Drago)

If you own premium real estate, stocks or other hard assets, you probably do feel like a winner. Plus, your bubble of information – Democratic strategists, cultists and economist cheerleaders – have all been touting the U.S.’s economic strength, despite the underlying reality.

But Michaels was clearly using her eyes, her experience and her common sense.

There has been a lot of gaslighting on the economy, which obfuscates the dire financial situation we find ourselves in. The pandemic response was an accelerator of destructive fiscal and monetary policy, a driver of massive non-merit-based inequality, and an accelerator of a future financial Armageddon.

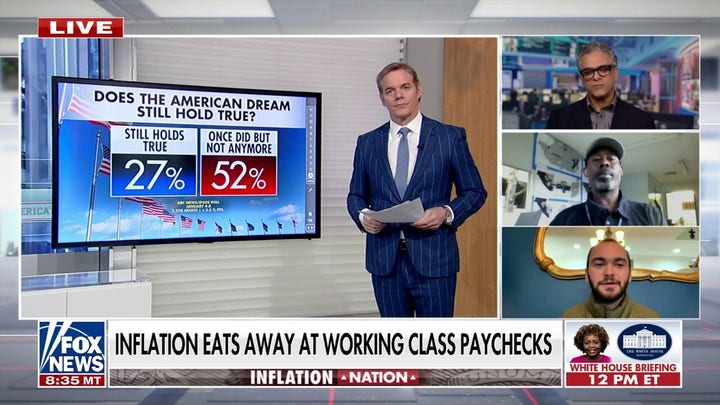

The U.S. has incurred more than $34 trillion in debt. It has debt-to-GDP levels that would have likely triggered a massive currency crisis if we were an emerging market and didn’t hold the world’s reserve currency. U.S. debt, as projected by the CBO’s recently released Budget and Economic Outlook for 2024-2034, is expected to hit historic levels of debt-to-GDP and to exceed $54 trillion in the aggregate.

ONLY 14% SAY THEY HAVE BEEN HELPED BY BIDEN'S ECONOMIC POLICIES

This is a path that has been labeled unsustainable by rating agencies, the CBO, the IMF, the Fed and the Treasury itself. JPMorgan Chase CEO Jamie Dimon has called it history’s "most predictable crisis." Yet, there is no believable plan or any conviction to change this trajectory.

The deficit-to-GDP is around double the historic average. This is significant vis-à-vis the window-dressing of the economy.

When someone points to economic "growth," what they are ignoring is how expensive it was to show that growth. In times of organic growth, "revenue" to the government increases and that cuts down the deficit.

It is highly unusual for growth to be accompanied by increasing deficits, let alone one that is running double the historic average as a percentage of GDP. This means that deficit spending was driving such growth, and doing so at a time when the cost of financing such deficits is near a 15-year high.

CLICK HERE FOR MORE FOX NEWS OPINION

That doesn’t sound so great..

Moreover, individuals are bearing tremendous costs, forcing many of them to take on multiple jobs. Persistent, compounding inflation has made it extremely challenging for most Americans to keep up with the basic costs of living. This has led the personal saving rate to go down well past historic averages and household debt to reach record levels. There has been an acceleration in delinquencies in various debt categories, including credit cards, as well.

Housing has become severely unaffordable. Rents are taking up a larger chunk of income, and buying a house has become, between asset inflation and high interest rates, unattainable. Policy has also locked up the supply of houses for sale, because nobody who has a low-interest mortgage can afford to move.

CLICK HERE TO GET THE FOX NEWS APP

So, no, we haven’t won anything economically and we are on a perilous trajectory by our government’s and the Fed’s policy decisions. That doesn’t even scratch the surface of what those decisions are doing vis-à-vis the global financial landscape and the consequences that will arise domestically from that.

Whether it is financial and economic illiteracy, a purposeful burying of heads in the sand, or an elite bubble, hiding from reality doesn’t make it better. We cannot fix what is clearly an unsustainable, fractured financial foundation until there is a wholesale connection with reality from those who are still so out of touch.