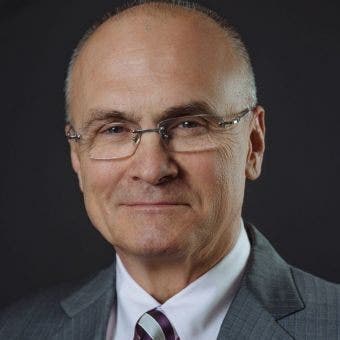

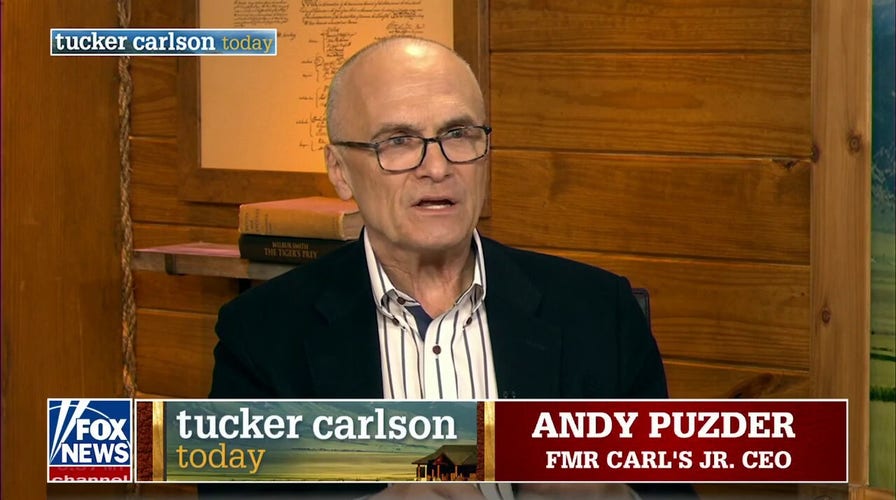

Andy Puzder: We're facing a group think on the left that's almost like a religion

Andy Puzder, former CEO of Carl's Jr., on the trends of hiring in corporations based on ESG investing and hiring quotas on 'Tucker Carlson Today.'

When your company’s market cap drops about 15 percent in five months despite a billionaire’s efforts to prop it up, you’ve got a problem. That’s where Anheuser-Busch InBev ("AB") finds itself after leftist crusader Bill Gates’ family foundation invested $95 million in 1.7 million AB shares in the second quarter of this year. At the beginning of that quarter, AB entered into a controversial partnership with transgender activist Dylan Mulvaney, sending Mulvaney, a biological male, custom beer cans to mark "365 days of girlhood." It was a public relations (and financial) fiasco.

Then there’s Disney, which has cut 7,000 jobs since 2021. The once family friendly brand has also watched its market cap drop about 40% since March of 2022, when Disney management went public with its opposition to a Florida parental rights bill and disclosed its intent to include woke sexual ideology in its content for children. Yep, Disney did that.

As a former CEO and a former corporate communications executive, we respectfully offer a suggestion for just about any business: Don’t offend your target market. That may sound obvious, but apparently it’s not. As AB’s and Disney’s results demonstrate, when management teams put politics over profits, "woke" ideology over brand image and customers’ loyalty, the consequences can be costly.

You have to wonder what the management team at Disney was thinking. With its theme parks and family friendly movies, Disney dominated the family entertainment marketplace for decades. An invaluable key to its success was that parents trusted Disney with their children. "It’s OK for the kids to watch, it’s a Disney movie" used to be a common parental refrain. That kind of trust is not something you willingly put at risk. You can’t get it back.

CLICK HERE FOR MORE FOX NEWS OPINION

So, it seemed out of character when Disney’s CEO opposed a Florida parental rights bill barring classroom instruction on gender and sexuality before the fourth grade (when children are around the ripe old age of 8). Why was Disney even taking a position on this issue? That became clearer as Disney management explained its intent to include woke sexual ideology in its content for children – no matter their parents’ values.

Disney executive producer Latoya Raveneau’s explained that her team had a "not-at-all-secret gay agenda" that was regularly "adding queerness" to children's programming with Disney’s blessing, as the company was "going hard" to be supportive.

So hard that Disney’s general entertainment content president Karey Burke promised to make at least half the characters in the company’s productions LGBTQIA and racial minorities by year’s end (a reflection of "woke" ideology rather than the makeup of our society).

And if there were any remaining doubt about Disney’s intent, it’s "diversity and inclusion manager" Vivian Ware proclaimed that Disney was eliminating any mention of "boys," and "girls" in its theme parks in order to create "that magical moment" for children who do not identify with traditional gender roles.

Surely, someone at Disney must have realized that such statements might offend the traditional family segment of its target market. If so, that person failed to speak up – or Disney didn’t care. In either event, customers apparently did.

A recent Wall Street Journal article titled "Disney World Hasn’t Felt This Empty in Years" credited "Disney’s recent price hikes and changes to park operations" for having "soured some families on visiting the Most Magical Place on Earth." Perhaps. But there was clearly more at play.

After reports of Disney’s plans to include sexual ideology in content for children, a poll by the Trafalgar Group found that over 68% of respondents were less likely to do business with Disney – including 48% of Democrats.

Perhaps not surprisingly, over the past 18 months, not only has Disney theme park business slowed, its movies have underperformed at the box office. And Disney’s streaming operation, which is where kids watch these days, shed 11.7 million subscribers worldwide in just the third quarter of this year (including losses in the US and Canada).

Investors noticed. Disney’s market cap was around $250 billion when the controversy began in early March 2022. Its market cap has since declined to around $150 billion, a $100 billion or 40% drop.

Sitting in its New York City offices, AB’s marketing department apparently failed to notice Disney’s travails. With iconic ads – virtually synonymous with Americana – AB built Bud Light into the nation’s highest annual sales volume brand for over two decades. Yet as of August 12, Modelo Especial surpassed it. Modelo had already displaced Bud Light as the largest selling beer brand on a monthly basis in May, following the Mulvaney beer can episode.

In fairness, AB’s partnership with Mulvaney was a one-off event. But it was way off. Apparently, AB ad execs actually thought beer drinkers would identify with a brand that supported a transgender activist in the midst of a nationwide social contagion of gender dysphoria. They didn’t.

As of July 29, Bud Light sales were down 14.5% for the year. Modelo Especial sales were up 9.6%, Miller Lite sales were up 19.2%, Coors Light rose 20.7%, Yuengling Traditional Lager rose 22.5% and Corona Extra sales rose 4.8%. Ouch!

CLICK HERE TO GET THE FOX NEWS APP

Why would AB involve itself in this controversy? Billy Busch, a member of the Busch family (which sold its shares in AB to InBev in 2008), had some advice for the beleaguered company: "When you are a foreign company and you rely on these woke students that are coming out of these local colleges to do your advertising for you, you’re making a big mistake. You need to go out there and understand who your core customer is."

It really isn’t rocket science.

So, how has this cultural disconnect impacted investors? AB’s market cap was around $130 billion when the controversy began in early April of this year. Its market cap today is $110 billion, a $20 billion or 15% decline in five months. I doubt Bill Gates will lose any sleep over it, but AB’s less affluent investors – including those with AB in their saving for retirement, pension funds or 401ks – likely have.

The lesson here is simple. If your company’s products appeal to people from all walks of life, "go woke, go broke" might be a slogan worth keeping in mind. Your customers and shareholders will thank you.

CLICK HERE TO READ MORE FROM ANDY PUZDER

Andy Olivastro, chief advancement officer at The Heritage Foundation, previously held executive roles at United Technologies (now RTX), Edelman, and the U.S. Department of Commerce.