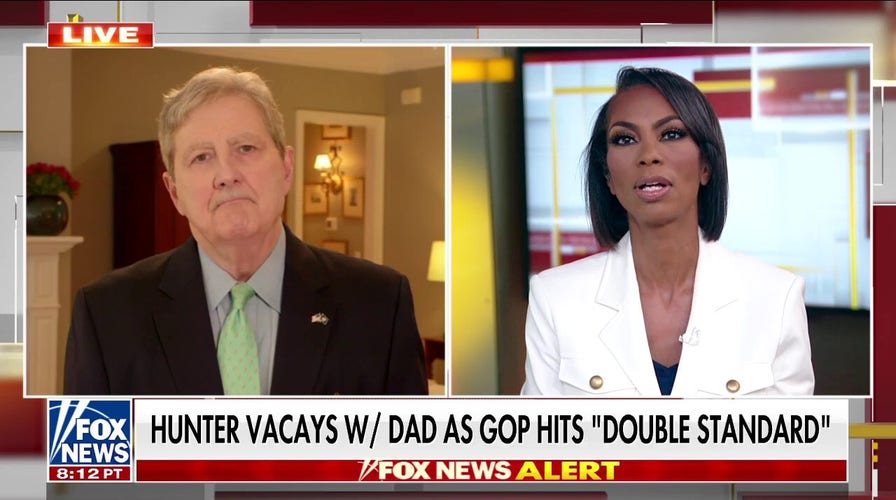

Sen. Kennedy: Biden and Manchin's 'inflation machine bill' will unleash the IRS on Americans to raise money

Sen. Kennedy, R-La., on the House of Representatives prioritizing the IRS over other policies in funding vote.

Democrats are moving to defend a proposed expansion of the Internal Revenue Service (IRS) under the Inflation Reduction Act, claiming that the increase in funding for the IRS will address the agency's "declining customer service" and not result in higher taxes for Americans making less than $400,000.

The proposed expansion includes an $80 billion boost to the IRS over a 10-year period, with more than half intended to help the agency crack down on tax evasion.

If the bill is passed, the money allotted would go toward filling 87,000 IRS positions, more than doubling the agency's current size. The measure, expected to receive a vote in the House on Friday, passed in the Senate over the weekend when Vice President Kamala Harris cast a tie-breaking vote.

"Let me be clear: No family making less than $400,000 will directly pay higher taxes," Rep. Gwen Moore, D-Wis., said in a statement to Fox News Digital. "Also, people will benefit from green energy tax credits, ACA premium subsidies and other crucial incentives."

MIDDLE-CLASS AMERICANS TO BEAR BRUNT OF IRS AUDITS UNDER DEM INFLATION BILL, ANALYSIS SHOWS

Democratic Reps. Gwen Moore of Wisconsin and Don Beyer of Virginia (Anna Moneymaker, Caroline Brehman/CQ-Roll Call, Inc via Getty Images)

"The Inflation Reduction Act increases IRS tax enforcement funding to go after sophisticated wealthy individuals and large corporations who dodge taxation, so they can finally pay their fair share, too," Moore added. "Unlike the GOP’s $2 trillion tax giveaway to the wealthy and big corporations, our tax policies will deliver a fairer tax system for working people."

Senate Democrats projected that enhancing IRS funding could add an extra $124 billion in federal revenue over the next decade by hiring more tax enforcers who can crack down on rich individuals and corporations attempting to evade taxes.

But Republicans warn the bill will fund an "army" of IRS agents to crack down on small business owners and lower-income workers. Americans who earn less than $75,000 per year are slated to receive 60% of the additional tax audits expected under the Democrats' spending package, according to an analysis released by House Republicans.

Aaron Fritschner, the communications director for Rep. Don Beyer, D-Va., a member of the House Ways and Means Committee, told Fox News Digital the congressman "feels strongly" that the Inflation Reduction Act is needed to address issues within the IRS and suggested that Americans "broadly support" efforts to ensure that wealthy Americans and corporations pay their "proper share" of taxes.

"The IRS enforcement funding in the Inflation Reduction Act is something Congressman Beyer feels strongly is needed to restore declining customer service, get working Americans their tax refunds in a timely manner, and prevent wealthy people and large corporations from avoiding their fair share of the tax burden," Fritschner said. "Tax avoidance costs the country many billions of dollars every year, and that revenue gap hurts everyone else."

The Internal Revenue Service headquarters building in the Federal Triangle section of Washington, D.C. (Chip Somodevilla/Getty Images)

"The American people broadly support requiring the wealthy and large corporations to shoulder their proper share of taxes, and when they see the difference between the real effects of the bill and the wildly dishonest claims being made about the IRS funding by the bill’s opponents, we think they will approve of this provision," he added.

TAX AND CLIMATE BILL COULD MASSIVELY EXPAND IRS UNION, WHICH ALMOST EXCLUSIVELY DONATES TO DEMOCRATS

Fritschner also refuted the GOP's claim that the measure will create an "army" of IRS agents who will target Americans.

"We would note in particular that the Inflation Reduction Act will not create an "army" of IRS agents, it will restore a workforce that has declined in size significantly since 2010, with further drops ahead due to retirements," he said. "IRS workers are also using systems that are woefully obsolete, and an upgrade will make the service they provide more efficient and more cost-efficient. These points have been underscored to Congress by the current IRS Commissioner Chuck Rettig, a Trump appointee."

House Republican analysis showed that individuals with an annual income of $75,000 or less would be subject to 710,863 additional IRS audits, while those making more than $1 million would receive 52,295 more audits under the bill.

Charles Rettig, Commissioner of the Internal Revenue Service, testifies before the Senate Finance Committee on Capitol Hill in Washington on April 7, 2022. (Kevin Dietsch/Getty Images)

CLICK HERE TO GET THE FOX NEWS APP

Overall, the IRS would conduct more than 1.2 million more annual audits of Americans' tax returns, according to the analysis. Another 236,685 of the estimated additional audits would target individuals with an annual income between $75,000 and $200,000.

In response to criticism about the expected uptick in tax audits under the bill, Rettig said Thursday that "audit rates" will not increase relative to recent years.

Fox News' Jessica Chasmar contributed to this report.