Fox News Flash top headlines for Sept. 30

Fox News Flash top headlines for Sept. 30 are here. Check out what's clicking on Foxnews.com

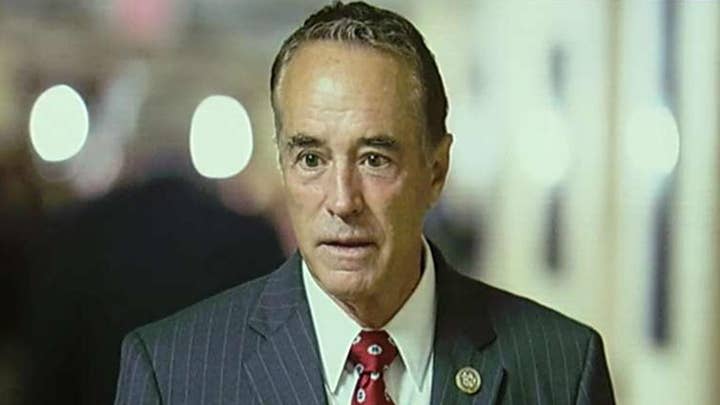

Rep. Chris Collins, R-N.Y., is expected to plead guilty later this week to insider trading charges, court documents indicate, marking an about-face for the embattled lawmaker who pleaded not guilty earlier this month.

The court documents say there will be a "change of plea hearing" when they appear in a Manhattan courtroom Tuesday. That appears to indicate that Collins, his son, Cameron, and his son’s prospective father-in-law, Stephen Zarsky, will plead guilty

Collins originally pleaded not guilty to a slew of charges brought against him last year and maintained his innocence when he was arraigned earlier this month on a superseding indictment that prosecutors hoped would speed up the case against the New York Republican.

NEW YORK REP. CHRISTOPHER COLLINS INDICTED ON INSIDER TRADING CHARGES

The superseding indictment against Collins streamlines the charges against the lawmaker by keeping only five of the original eight securities fraud counts from the original indictment. The new indictment also drops two of the original eight securities fraud charges against the congressman's son while leaving the remaining charges in place.

"The government has made these modifications in the original indictment in an effort to avoid unnecessary pretrial litigation that could delay the resolution of the matter," Geoffrey S. Berman, the U.S. Attorney for the Southern District of New York, wrote in a recent letter to the judge in the case.

The fraud counts against Collins relate to securities of an Australian biotechnology company called Innate Immunotherapeutics, where the 69-year-old congressman served on the board.

Prosecutors allege that Collins passed along secrets to his son in June 2017. They say the son traded on the inside information and passed it to Zarsky. They added that Zarsky traded on it and tipped off at least three others.

According to the original indictment, Collins specifically got early word that a drug the company developed to treat multiple sclerosis wasn't performing well in a medical trial and passed on the tip to his son.

Prosecutors said the three avoided over $768,000 in losses by trading ahead of the public announcement of the failed drug trials.

The advocacy group Public Citizen filed a request for an investigation of Collins' stock dealings with the Office of Congressional Ethics and the Securities and Exchange Commission in January 2017.

CLICK HERE FOR THE ALL-NEW FOXBUSINESS.COM

The congressman, who has served New York's 27th District since 2013, surrendered to federal agents in Manhattan last August.

Following the charges brought against Collins last year, then-House Speaker Paul Ryan removed Collins from his post on the House Energy and Commerce Committee and called the insider trading charges "a clear violation of the public trust."

Collins has a track record of publicly backing Trump, including being one of the first sitting members of Congress to endorse his candidacy. While he originally said last year that he would not seek re-election following the indictment leveled against him, he reversed course and eventually defeated Democrat challenger Nate McMurray – albeit by a much narrower margin than previously expected, 49.1 percent to McMurray’s 48.8 percent.

The Associated Press contributed to this report.