Fox News Flash top headlines for May 2

Fox News Flash top headlines for May 2 are here. Check out what's clicking on Foxnews.com

It took just seven minutes for Illinois state senators on Wednesday to advance major legislation that would revamp how personal income is taxed since the state income tax was enacted 50 years ago.

The 40-19 vote in the Democrat-controlled Senate approved a proposed amendment to the state constitution to eliminate the flat tax requirement and paved the way for a graduated-rate income tax, which would charge higher rates on higher incomes, the Chicago Sun-Times reported. The plan is a top legislative priority of Democratic Gov. J.B. Pritzker.

The state House -- also led by Democrats -- must approve the same proposal for it to be put before voters in 2020.

Illinois Gov. J.B. Pritzker, right, has made eliminating the state's flat tax a legislative priority. (AP Photo/John O'Connor)

ILLINOIS GOV. PRITZKER UNDER FEDERAL INVESTIGATION FOR TAX BREAK ON MANSION: REPORT

“This is the first step in a decades-long effort to modernize our tax code,” state Sen. Don Harmon said in introducing the resolution.

During the short debate on the matter -- which the Sun-Times noted took up less time than Led Zeppelin's classic rock song, "Stairway to Heaven" -- state Sen. Republican Leader Bill Brady said the change “severely puts at risk raising taxes higher,” for the middle class. He said he believes voters will reject the constitutional amendment at the ballot box.

Pritzker, a billionaire heir to the Hyatt Hotel fortune who took office last year, made his graduated tax plan a centerpiece of his campaign for governor. He applauded the Senate for “taking a major step forward to create a fair income tax system in Illinois, ensuring that 97 percent of taxpayers will pay the same or less and only those making $250,000 will pay more,” according to the Chicago Tribune.

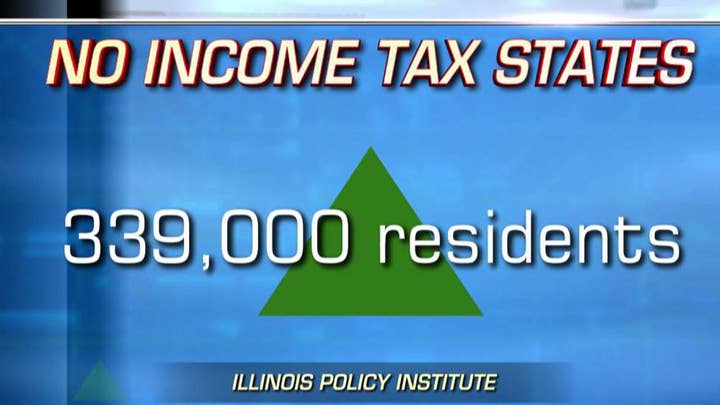

HIGH-TAX STATES KEEP RAISING TAXES, DESPITE RESIDENTS' EXODUS: VARNEY

Democrats believe raising taxes on the rich will help close an estimated $3.2 billion budget gap, according to the Tribune. Republicans who opposed to the plan argue doing away with the flat tax would lead to tax increases on people earning less than $250,000.

“There are a handful who believe that the answer to government’s problems is simply to raise taxes,” Republican Sen. Dale Righter said. “This will make it easier for those who believe that to reach into your constituents’ pockets and get more money. We should not make it easier.”

“There are a handful who believe that the answer to government’s problems is simply to raise taxes. This will make it easier for those who believe that to reach into your constituents’ pockets and get more money. We should not make it easier.”

Without any Republican votes, the Senate approved a slew of packages that would take effect if voters approve the constitutional amendment, according to the Sun-Times.

CLICK HERE TO GET THE FOX NEWS APP

One bill would freeze school district property taxes if the state meets funding obligations for education while another would repeal the so-called “death tax,” or tax of the value of an estate someone inherits.

Also passed was a bill that includes new tax rates that raises the top income tax rate to 7.99 percent — up from Pritzker’s proposed 7.95 percent — and separating rates for single and joint filers.