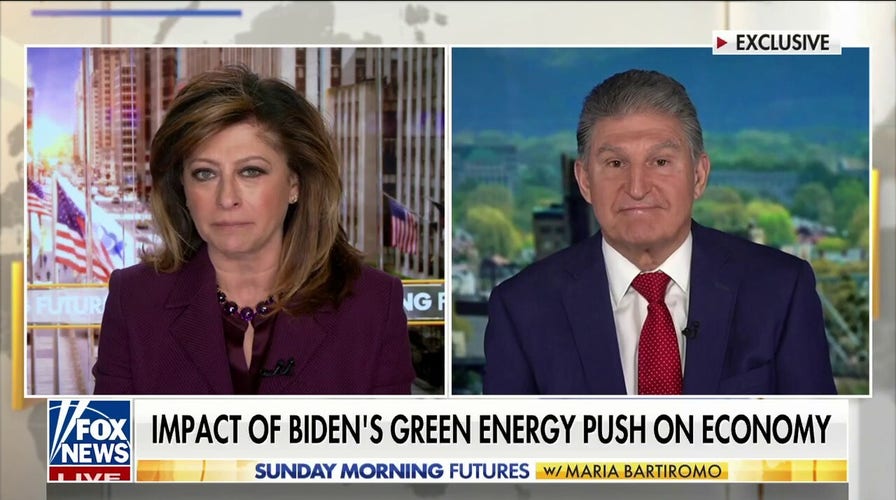

Joe Manchin: Weight of our own debt is the 'greatest threat we face'

Sen. Joe Manchin, D-W.V., on revoking 'most favored nation status' for China, energy independence and reining in U.S. government spending.

Sen. Joe Manchin, D-W.Va., issued a scathing statement Friday after the Biden administration issued rules governing which electric vehicles (EV) are eligible for tax credits under the Inflation Reduction Act (IRA).

Manchin, who chairs the Senate Energy and Natural Resources Committee, said the Treasury Department rules strengthen Chinese supply chains and Chinese Communist Party-affiliated companies despite the IRA being designed to reduce U.S. reliance on China. The Democrat was a lead sponsor of the IRA which Congress passed and President Biden signed into law in August.

"Yet again – the guidance released by the Department of the Treasury completely ignores the intent of the Inflation Reduction Act. It is horrific that the Administration continues to ignore the purpose of the law which is to bring manufacturing back to America and ensure we have reliable and secure supply chains," Manchin said Friday. "American tax dollars should not be used to support manufacturing jobs overseas."

"It is a pathetic excuse to spend more taxpayer dollars as quickly as possible and further cedes control to the Chinese Communist Party in the process. The guidance includes a 60-day comment period and I ask for every American to comment," the West Virginia lawmaker continued. "My comment is simple: stop this now – just follow the law."

Sen. Joe Manchin, D-W.Va., applauds after President Biden signs the Inflation Reduction Act. (Drew Angerer/Getty Images)

The Treasury Department rules announced Friday outline the sourcing requirements for critical minerals and battery components automakers must use in EV batteries to ensure eligibility for the full $7,500 credit. The IRA requires EV batteries to contain a certain amount of critical minerals and components from the U.S. or nations the U.S has entered into a free trade agreement with.

However, the Biden administration declined to provide clarity on a potential loophole in the IRA.

In February, Ford announced it would partner with the massive Chinese tech company Contemporary Amperex Technology (CATL) to build a new EV battery plant in Michigan. While Ford said CATL would have "limited involvement" as a contractual service provider and licensor of technology to Ford, the Chinese company still stands to indirectly benefit if EVs built with the batteries manufactured at the plant receive IRA tax credits.

Tesla is similarly planning to build a U.S. battery plant utilizing CATL's technology, Bloomberg reported Thursday.

When asked during the press call ahead of Friday's announcement, an administration official declined to comment on specific deals like the Ford-CATL agreement, but said it was good the IRA was incentivizing international companies to bring capital to the U.S.

President Joe Biden makes his entrance at General Motors' electric vehicle assembly plant in Detroit, Michigan, on Nov. 17, 2021. (Nic Antaya/Getty Images)

In addition, the Treasury Department deferred how it will implement an IRA provision that bars EVs assembled with any battery components or critical minerals sourced from a "foreign entity of concern" beginning in 2024 and 2025, respectively. A separate administration official told reporters that specifics on how that provision will be implemented would be clarified on a later date.

Ford, Hyundai and various industry groups like the Zero Emission Transportation Association, which includes companies including Tesla, Rivian and Uber, have implored the Treasury Department to issue looser IRA guidance to ensure more vehicles are eligible. They have taken particular issue with an expansive interpretation of what constitutes a "foreign entity of concern."

BIDEN ADMIN QUIETLY ADDS WORKAROUND, MAKING PRICEY SPORTS CARS ELIGIBLE FOR EV TAX CREDITS

Because China likely falls into that classification, depending on how the Treasury Department interprets the law, the IRA may disqualify EVs with any Chinese-sourced components and minerals from being eligible for the credit. China currently boasts 78% of the world’s cell manufacturing capacity for EV batteries, according to a Brookings Institution analysis released last year.

Ford CEO Jim Farley announces a partnership with Chinese battery company CATL to build an electric vehicle battery plant in Michigan. A Biden administration official said it was good international companies are bringing capital to the U.S. (Bill Pugliano/Getty Images)

"It's shocking that Ford is doing this," former White House National Security Advisor Robert O'Brien told Fox News Digital in February. "We just had a Chinese spy balloon traverse the length and breadth of our country and violate our sovereignty. And Ford is partnering with our leading competitor, our adversary, to work on battery technology and build batteries here in America."

"On top of that, they're trying to work out a loophole to get U.S. taxpayers to support and subsidize their dealings with China and to bolster a Chinese company with U.S. tax dollars, the tax credits in the Inflation Reduction Act," he continued. "It's a total perversion of the Inflation Reduction Act which was intended to bring manufacturing home with U.S. supply chains and exclude the Chinese."

CLICK HERE TO GET THE FOX NEWS APP

And the Treasury Department also said Friday that critical minerals contained in an EV's battery must have been extracted or processed in the U.S. or listed allied nations. The wording of the provision potentially allows automakers to use critical minerals extracted in an allied nation, but processed in an unlisted nation.