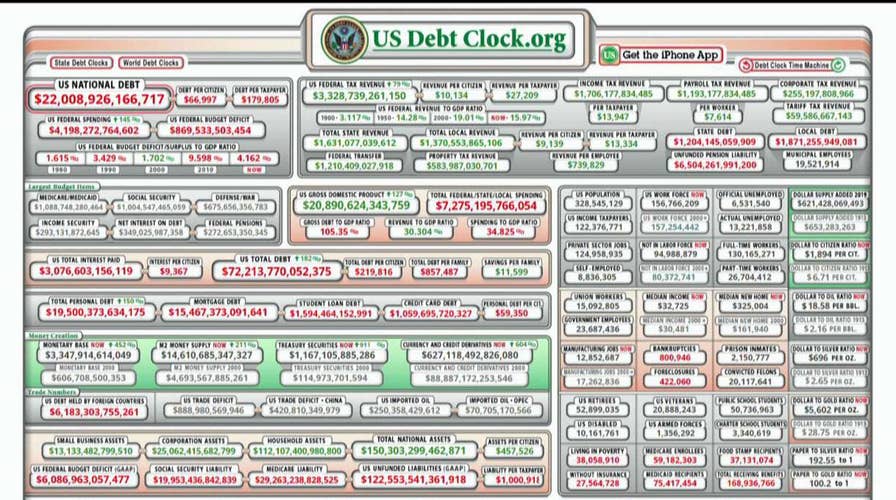

The national debt — the total of annual budget deficits — has reached a new milestone, topping $22 trillion for the first time.

The Treasury Department’s daily statement showed Tuesday that total outstanding public debt stands at $22.01 trillion.

It stood at $19.95 trillion when President Trump took office on Jan. 20, 2017.

OMAR SMASHED OVER SNEERS AT JEWISH MONEY IN POLITICS

The debt figure has been rising since the passage of Trump’s $1.5 trillion tax cut in December 2017, and the action by Congress last year to increase spending on domestic and military programs.

However, the U.S. government’s debt has been rising for decades: In 1989 it stood at $3.1 trillion; in 1999: $5.6 trillion; and in 2009: $11.9 trillion.

Republican John Kasich, former Ohio governor, sent a tweet of astonishment Tuesday evening, showing a photo of him in front of a debt clock: “This photo was taken Feb. 3, 2016 while campaigning in New Hampshire. Our national debt has swelled to $22 TRILLION dollars in that time. That’s $3 Trillion more in only three years! This is out of control.”

In December, Kasich told Fox News he was “actively considering” mounting a primary challenge to Trump in the 2020 election.

The Congressional Budget Office (CBO) projects that this year’s deficit will be $897 billion — up from last year's $779 billion.

In the coming years, the CBO said the debt is expected to keep going up, top $1 trillion annually beginning in 2022 and never drop below $1 trillion through 2029.

Much of the increase will come from mounting costs to fund Social Security and Medicare as the vast generation of baby boomers segues into retirement.

CAL THOMAS: AMERICA IS DROWNING IN DEBT

The Trump administration contends that its tax cuts will eventually pay for themselves by goosing economic growth. That projection has been disputed by some economists.

Despite the rising levels of federal debt, many economists say they think the risks remain slight and point to current interest rates, which remain unusually low by historical standards.

CLICK HERE TO GET THE FOX NEWS APP

Still, some budget experts warn that ever-rising federal debt poses substantial risks for the government because it could make it harder to respond to a financial crisis through tax cuts or spending increases.

The Associated Press contributed to this report.