Fox News Flash top headlines for February 2

Fox News Flash top headlines are here. Check out what's clicking on Foxnews.com.

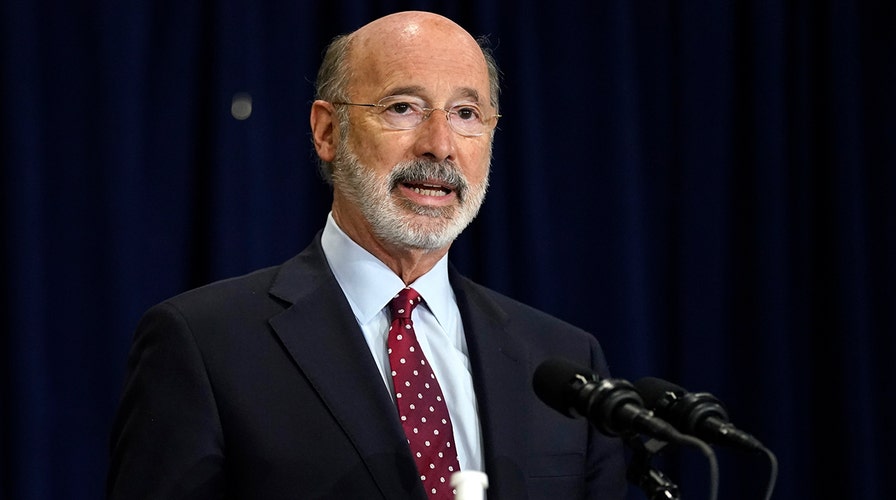

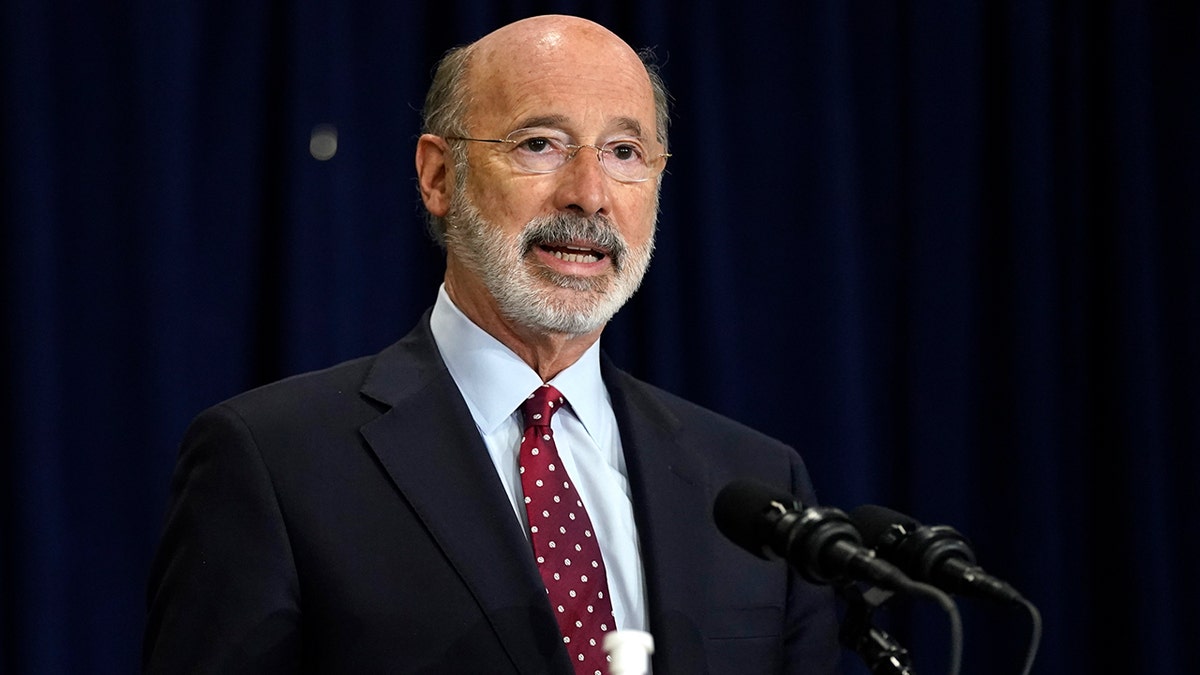

Democratic Pennsylvania Gov. Tom Wolf wants to raise taxes on wealthy residents and the natural gas industry to help pay for new investments into education and coronavirus relief.

The governor’s proposal will call for increasing the personal income tax rate from 3.07% to 4.49%.

The reported budget plan follows a statement Tuesday in which Wolf’s office said 67% of Pennsylvania taxpayers would see tax cuts or have their taxes stay the same under his plan to cut costs for working class households while raising billions to invest in education and "workforce development."

FILE - In this Nov. 4, 2020, file photo, Pennsylvania Gov. Tom Wolf speaks during a news conference in Harrisburg, Pa., regarding the counting of ballots in the 2020 general election. Facing a deep, pandemic-inflicted budget deficit, Gov. Wolf will ask lawmakers for billions of dollars funded by higher taxes on Pennsylvania’s huge natural gas industry for workforce development and employment assistance to help the state recover. (AP Photo/Julio Cortez, File)

"Now is the time to act boldly to remove the barriers to success Pennsylvania families are facing," Wolf tweeted Tuesday afternoon.

PENNSYLVANIA REVEALS NEW STREAMLINED HUNTING AND FISHING LICENSE SYSTEM

It would mark the first personal income tax hike in the state since 2003, Penn Live reported.

Nearly half of the new revenue would go toward education spending.

The coronavirus pandemic also exposed glaring inequities for low-wage workers, minorities and the disabled, according to Wolf, who is calling for billions of dollars to go toward workforce development and "re-employment assistance" for workers laid off amid the COVID-19 crisis.

Proposed new taxes on recreational marijuana and fracking would offset those expenses, according to Wolf’s office.

"Families with two children making less than $84,000 will receive a tax cut while a family of four making $50,000 will have their taxes eliminated," according to the governor’s office.

Another part of his 2021 plans would send $145 from the state’s Workers Compensation Security Fund directly to state businesses suffering under the coronavirus’ squeeze on the economy.

CLICK HERE TO GET THE FOX NEWS APP

Wolf also proposed increasing Pennsylvania’s minimum wage to $12 an hour, with a pathway to $15.

Wolf is expected to formally announce his budget plan on Wednesday. The 2021-2022 budget year begins on July 1.

The Associated Press contributed to this report.