Finding origins of COVID-19 is up to Congress: Michael Shellenberger

Author Michael Shellenberger says Congress needs a bipartisan commission, similar to the panel that investigated 9/11, to look into the origins of COVID.

FIRST ON FOX: The Republican chairman of the House Committee on Small Business is accusing the Small Business Administration (SBA) of failing to protect coronavirus loan programs from fraud after a government report found that the agency disbursed over $200 billion in possibly fraudulent COVID-19 loans, nearly double that which was previously expected.

The Small Business Administration Office of the Inspector General said in its report on COVID-19 pandemic loan fraud on Tuesday that the agency disbursed more than $200 billion in potentially fraudulent PPP loans and Economic Injury Disaster Loans during the pandemic.

In total, the SBA's Office of the Inspector General said there were 4.5 million potentially fraudulent loans and grants from pandemic loan programs.

The Office of the Inspector General said the SBA "did not have an established strong internal control environment for approving and disbursing program funds," adding that "there was an insufficient barrier against fraudsters accessing funds that should have been available for eligible business owners adversely affected by the pandemic."

COVID-19 RELIEF FRAUD LED TO BILLIONS IN TAXPAYER-FUNDED PAYCHECK PROTECTION PROGRAM LOANS LOST

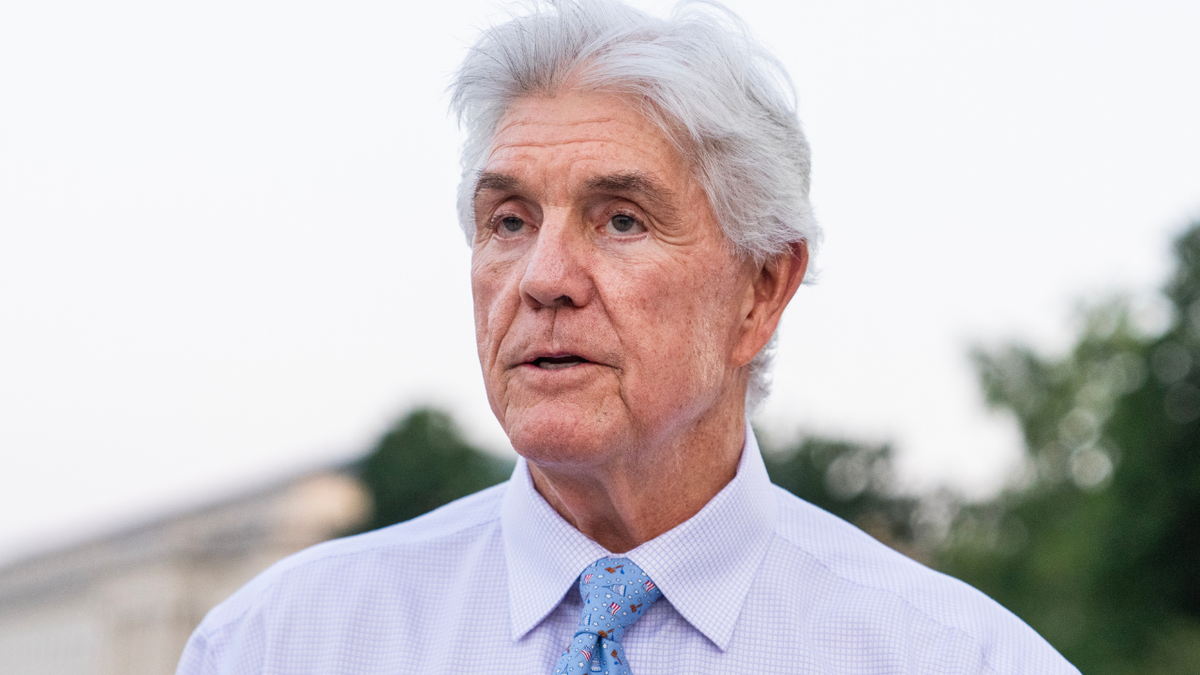

Rep. Roger Williams, R-Texas, arrives for the House vote on Fiscal Responsibility Act, which will raise the debt limit, outside the U.S. Capitol on Wednesday, May 31, 2023. (Tom Williams/CQ-Roll Call, Inc via Getty Images)

Rep. Roger Williams, R-Texas., said in a statement to Fox News Digital that the Office of the Inspector General report shows significantly more criminal activity occurred than was previously known.

"These findings show the SBA failed to implement basic guardrails to protect the integrity of these programs, resulting in roughly 1 in 5 loans dispersed being labeled as potentially fraudulent."

"These findings show the SBA failed to implement basic guardrails to protect the integrity of these programs, resulting in roughly 1 in 5 loans dispersed being labeled as potentially fraudulent. When COVID-19 hit the United States, the SBA was tasked with taking on an oversized role to help save small businesses and our nation’s job creators. Unfortunately, these after-action reports show the agency was not up to the task. I look forward to hearing directly from Inspector General Ware in July on what went wrong, how to fix these issues, and what recourse we must take to recoup these stolen taxpayer dollars," Williams said.

PPP FRAUD CHARGES BROUGHT AGAINST CEOS, CELEBRITIES IN GEORGIA

Small Business Administration building (U.S. Government Accountability Office)

According to the Office of the Inspector General report, SBA management said that the report contains "serious flaws that significantly overestimate fraud." The Office of the Inspector General said in response that "we remain confident in our estimates of potential fraud for the COVID-19 EIDL program and PPP."

READ THE REPORT BELOW. APP USERS: CLICK HERE.

CLICK HERE TO GET THE FOX NEWS APP

Nominee for Administrator of the Small Business Administration Isabella Casillas Guzman attends her confirmation hearing before the Senate Small Business and Entrepreneurship Committee on February 3, 2021 in Washington, DC. Previously Guzman served as the Director of California's Office of the Small Business Advocate. (Bill O'Leary-Pool/Getty Images)

In a press release by the Small Business Administration, Administrator Isabella Casillas Guzman said that "Pandemic relief programs, including those supported by President Biden’s American Rescue Plan, have driven a historic economic recovery, including saving millions of businesses and creating over 13 million jobs since 2021."

Han Nguyen, a spokesperson for the SBA, told Fox News Digital that "We strongly disagree with the OIG's projected fraud total of $200 billion suggested by the OIG report."

"It is vital to clarify that 86% of the likely fraud in the PPP and COVID-EIDL programs occurred in the first nine months of those programs when, as the SBA IG has often noted, the rush to get funds out led to unwise decisions to pull down anti-fraud guardrails," Nguyen said. "SBA strongly believes that the SBA IG significantly over states the degree of even potential fraud under COVID-EIDL by ignoring or discounting COVID-EIDL repayment data."