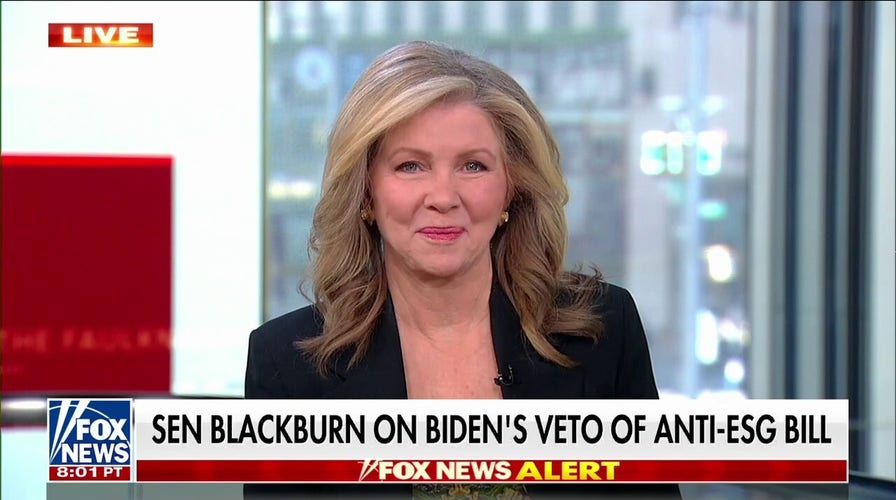

Sen. Marsha Blackburn reacts to Biden vetoing bill restricting ESG: 'Very political move'

Sen. Marsha Blackburn, R-Tenn., joined 'The Faulkner Focus' to discuss Biden's first veto and the impact of Biden's policies on the border crisis.

EXCLUSIVE: A coalition of 21 state attorneys general sent a stark warning to dozens of financial institutions and asset managers, warning them against pursuing woke environmental and social initiatives.

In a letter sent Thursday to 53 of the nation's largest financial institutions, which collectively manage trillions of dollars worth of assets, the attorneys general threatened to take legal action if the firms veer from the best interests of their clients while pushing social priorities. The effort, led by Montana, Utah and Louisiana, comes ahead of proxy season during which most companies hold annual shareholder meetings where they vote on key policy initiatives.

"This ESG nonsense is filtering into a lot of our states and the way they're doing it is really, really concerning and probably flagrantly illegal," Montana Attorney General Austin Knudsen told Fox News Digital in an interview. "Pushing it through these asset managers and through these proxy votes is extremely concerning."

"The message is: 'Stay in your lane and do what you're supposed to do. You have a fiduciary obligation under our various states laws to maximize investment. That's your job. That's what you're supposed to be doing. We're aware of state law and if it needs be, we will defend our state pensioners against anything outside that lane.'"

REPUBLICAN STATES ARE PLANNING AN ALL-OUT ASSAULT ON WOKE BANKS: 'WE WON’T DO BUSINESS WITH YOU'

Montana Attorney General Austin Knudsen, Utah Attorney General Sean Reyes and Louisiana Attorney General Jeff Landry led the effort on Thursday. (Fox News)

The letter, first obtained by Fox News Digital, stated that in recent years large asset managers, which hold majority stakes in major publicly-traded companies, have used client assets to change companies' behavior to align with so-called environmental, social and governance (ESG) standards.

Critics — including attorneys general, state treasurers, the energy industry and consumer advocacy groups — have accused ESG-focused asset managers of sidestepping their legally-mandated fiduciary duty of looking out for the wellbeing of clients whose money they manage.

25 STATES HIT BIDEN ADMIN WITH LAWSUIT OVER CLIMATE ACTION TARGETING AMERICANS' RETIREMENT SAVINGS

"You are … not only bound to follow the general laws discussed above but also have extensive responsibilities under both federal and state laws governing securities," Knudsen and the other attorneys general stated in the letter. "Broadly, those laws require you to act as a fiduciary, in the best interests of your clients and exercising due care and loyalty."

"Simply put, you are not the same as political or social activists and you should not be allowing the vast savings entrusted to you to be commandeered by activists to advance non-financial goals," it continued.

Protesters demonstrate outside the BlackRock headquarters in New York City during the company's annual shareholders meeting in 2022. (Erik McGregor/LightRocket via Getty Images)

The attorneys general took particular issue with ESG practices that push aggressive climate policies which opponents have argued would hamper the fossil fuel industry and increase consumer energy prices.

The letter Thursday highlighted that asset managers participate in Climate Action 100+ and have joined the Net Zero Asset Managers Initiative (NZAM). The two associations require members to make certain climate commitments.

LOUISIANA DIVESTS FROM BLACKROCK OVER ESG POLICIES: 'WOULD DESTROY LOUISIANA’S ECONOMY'

For example, the NZAM requires members to "accelerate the transition towards global net zero emissions and for asset managers to play our part to help deliver the goals of the Paris Agreement." NZAM members also commit to implement "a stewardship and engagement strategy, with a clear escalation and voting policy, that is consistent with [their] ambition for all assets under management to achieve net zero emissions by 2050 or sooner."

And the Climate Action 100+ initiative seeks commitments from boards and senior management to "reduce greenhouse gas emissions across the value chain" via net zero commitments.

"None of this is financially defensible," the attorneys general stated in their letter. "Instead, it is a transparent attempt to push policies through the financial system that cannot be achieved at the ballot box."

A person walks past pump jacks operating in Bakersfield, California. (AP Photo/Jae C. Hong/ File)

Knudsen added that he was concerned ESG policies would ultimately harm Montana residents by reducing their energy options and hiking prices.

"Montana's a northern state. It gets really, really cold," he told Fox News Digital. "We can't heat our homes with rainbows and fairy dust. That's basically what we're talking about here when we're talking about solar or wind power. When it's 40 below in February in Montana, the sun doesn't shine and the wind doesn't blow."

"We've got a million people to keep warm. So, we have to have reliable energy," he said. "And Montana is an energy producing state. We do produce oil, we do produce natural gas, and we do produce some of the highest quality coal in the world. So, I mean, to me, that's a no-brainer."

CLICK HERE TO GET THE FOX NEWS APP

Knudsen noted that New York-based BlackRock, one of the asset managers addressed in the letter, owns a 25% stake in NorthWestern Energy, Montana's largest regulated utility company.

BlackRock, which alone manages more than $8.5 trillion, has explicitly leveraged client funds to push green transition policies to combat global warming. In 2021, the firm's CEO Larry Fink said that pension funds, foundations and endowments "should have a loud voice with [fossil fuel] companies to move forward."

The letter Thursday also warned against taking certain actions promoting race and gender quotas or abortion. More than 20 abortion-related proxy measures have been proposed this year, more than every other year combined, according to the shareholder advocacy group As You Sow.

In addition to BlackRock, the letter was sent to Franklin Templeton, Goldman Sachs, HSBC, Invesco, JP Morgan, State Street and dozens of other asset managers.