Former IRS Lawyer: IRS is influenced by Washington lobbyists

Former IRS lawyer William Henck details claims from IRS whistleblowers that the bill will target the middle class

Several House Democrats facing tough re-election bids, as well as one congressional hopeful, are defending their party's expansion of the Internal Revenue Service that was included in the so-called Inflation Reduction Act, which does little to immediately address inflation in America.

The measure, backed by Sen. Joe Manchin, D-W.Va., successfully passed through the Democrat-controlled chambers last month and was later signed by President Biden, will grant an $80 billion boost to the IRS over a 10-year period, with more than half of the funds intended to help the agency crack down on tax evasion.

The billions of dollars for the IRS from the measure will go toward filling 87,000 IRS positions, more than doubling the agency's current size.

Illinois Democrat Rep. Sean Casten, who is seeking to retain his seat in the House this November in the midterm elections, recently claimed that the funding for the IRS is going towards "resources" that the agency needs.

CBO SAYS DEMOCRATS' TAX HIKE AND SOCIAL SPENDING BILL WILL INCREASE IRS ENFORCEMENT ON MIDDLE CLASS

Democratic Reps. Sean Casten of Illinois, Abigail Spanberger of Virginia, and Tom O'Halleran of Arizona. (Kevin Dietsch, Tom Williams/CQ-Roll Call, Inc. via Getty Images)

"I'm sorry that Republicans feel the government shouldn't work. I respectfully disagree. Government should work," Casten said during an interview with Chicago's WGN-TV.

"The Trump head of the IRS told us last term that the amount of money collected by the IRS every year is a trillion dollars less than the amount that is due in taxes and that's because the IRS has been so historically underfunded," Casten claimed. "What is causes is the IRS only audits people at the bottom end of the income scale because they don't have the resources to do really complicated audits."

Casten said the Democrats gave the IRS "resources" they needed so "that they can now go through."

"Some of this is indeed for people to do audits," Casten added. "Janet Yellen has expressly directed them, don't audit anybody under $400,000.... They just need the resources. The IRS has not had the ability to digitize all the tax records. That's shameful in 2022 they don't have that."

During an interview with MSNBC's "Morning Joe" last month, Rep. Abigail Spanberger, D-Va., who is seeking re-election to represent Virginia's 7th Congressional District, rejected the notion that there would be "87,000 armed IRS agents" coming for middle-class Americans.

"In my conversations with my colleagues, I've been very clear in the danger that exists when people are so willing to lean into lies, like the lie of 87,000 armed IRS agents," she said. "That is not real. That is not true. And yet, we see members of Congress and people who want to head to Congress who are willing to call the FBI names, accuse them of being corrupt, all for political gain."

In a recent interview with the Arizona Daily Star, Kirsten Engel, a former Arizona state senator who is seeking to represent the state's Sixth Congressional District in the House, said she supported the Inflation Reduction Act because "everybody has to do their fair share of paying taxes" and that it's "fair."

"Why did I support that? First of all, I'm running for office right now, so that was not a vote that I took, but I do support the Inflation Reduction Act," Engel said. "It's got fabulous things here for Arizona in terms of building up our economy in the clean power sector and recall this is also the bill that is gonna help us crack down on the cost of prescription drugs for Medicare beneficiaries, cap the cost of insulin and part of the way it's gonna fund our ability to make sure people are not paying crazy amounts for, you know, prescription drugs. How we can jumpstart our renewable energy economy, build that EV charging infrastructure, is to make sure people are paying their taxes."

"So, my understanding is there's actually a cutoff. I think there's some sort of cutoff, it's only people with incomes over $400,000 I believe," she added. "People who should be paying their taxes. We're not talking about new taxes, we're talking about people paying their taxes. I pay my taxes, I hope you pay your taxes.… This is part of the bargain. We pay our taxes, we also have input into our government and what we tax and who is taxed. The tax law is the tax law. If we need to enforce it to make sure people pay their taxes, that's just fair. Everybody has to do their fair share of paying their taxes."

The Internal Revenue Service federal building located in Washington, D.C., shown in 2020. (istock)

Last month, during an interview with InMaricopa, Arizona Democratic Rep. Tom O'Halleran claimed the cost of hiring thousands of new agents would be offset by the tax income that the measure would allegedly bring in through its increased auditing of Americans, and that it would also help reduce the budget deficit.

The topic came up roughly 20 minutes into the interview when the reporter asked O'Halleran, who running for re-election to the House to represent Arizona's Second Congressional District, if the additional agents would be targeting corporations, "high-end individuals" or "more than that" with their audits.

"High-end individuals and corporate," O'Halleran said, adding that it would take time to hire that many agents due to a "difficult" job market. "People look at it and say, well, how come so many? Well, find out how many people a corporation uses to put its tax structure together, and how many attorneys, and how much court time is taken up," he added.

VULNERABLE HOUSE DEMOCRATS DEFEND VOTE ON INFLATION REDUCTION ACT, EXPANSION OF IRS

"But the overriding issue is 87,000 people — when you've had an agency that hasn't had the personnel within the last decade and a half to be able to address it, it's important that we have the revenue streams," he added. "We don't want to overtax people, obviously, but we have to invest in America. And if we don't invest in America, it's going to cost us a lot more."

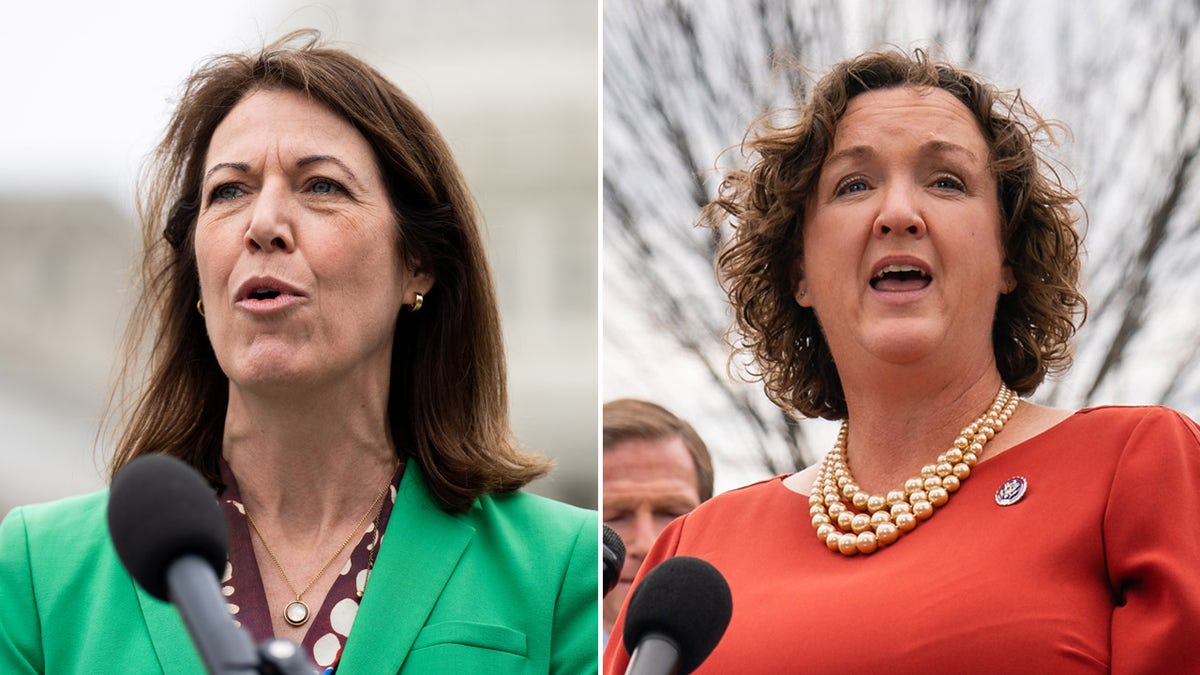

Two other House Democrats — Rep. Katie Porter of California and Rep. Cindy Axne of Iowa — have also defended the measure's success and defended their votes in favor of it.

"We're investing in the IRS because right now, $160 billion in taxes go unearned into our country's coffers that would help all of you with our schools, and with our roads, and with our healthcare, and with all of the important things this country needs because we don't have enough IRS auditors to address the issues that we're facing," Axne, who has served in Congress since 2018 and is seeking re-election, said at a recent event put on by the Des Moines Register.

Democratic Reps. Cindy Axne of Iowa and Katie Porter of California. (Eric Lee/Bloomberg, Bill Clark/CQ-Roll Call, Inc via Getty Images)

Similarly, Porter, who has represented California's 45th Congressional District in the House since 2019, insisted during a recent appearance on MSNBC that Americans "would like to have" more agents within the IRS and that the "thrust of the bill is bringing down costs for American families in the short term."

Prior to the House's passage of the measure, Senate Democrats projected that enhancing IRS funding could add an extra $124 billion in federal revenue over the next decade by hiring more tax enforcers who can crack down on rich individuals and corporations attempting to evade taxes.

However, Republicans warned the bill would fund an "army" of IRS agents to crack down on small business owners and lower-income workers. Americans who earn less than $75,000 per year are slated to receive 60% of the additional tax audits expected under the Democrats' spending package, according to an analysis released by House Republicans.

CLICK HERE TO GET THE FOX NEWS APP

House Republican analysis showed that individuals with an annual income of $75,000 or less would be subject to 710,863 additional IRS audits, while those making more than $1 million would receive 52,295 more audits under the bill.

Overall, the IRS would conduct more than 1.2 million more annual audits of Americans' tax returns, according to the analysis. Another 236,685 of the estimated additional audits would target individuals with an annual income between $75,000 and $200,000.

Fox News' Brandon Gillespie and Jessica Chasmar contributed to this report.