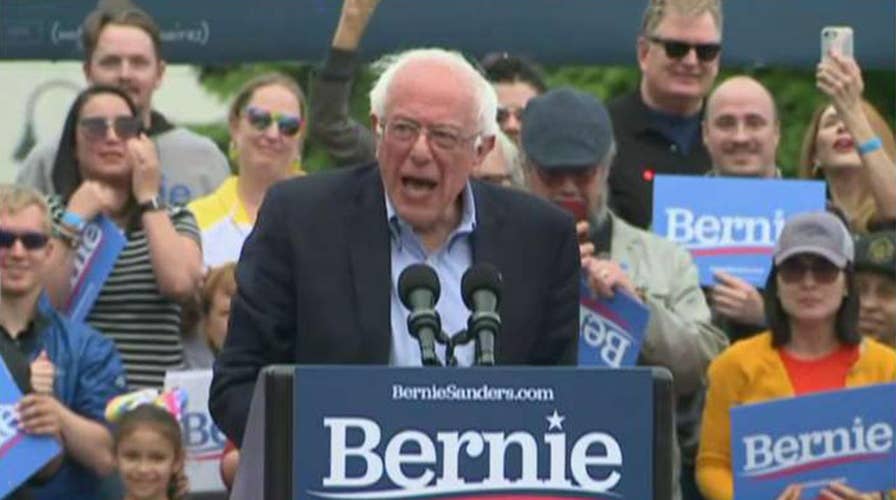

Bernie Sanders not slowing down after heart attack

DNC communications director Xochitl Hinojosa says Bernie Sanders is using his heart attack as a messaging moment to talk about the importance of health care.

Two economists at the University of California, Berkeley claim that billionaires could face a 97.5 percent average effective tax rate under Sen. Bernie Sanders’ plan, which would easily thump other Democrats running for president in 2020.

Emmanuel Saez, one of the professors, told Bloomberg that “with the wealth tax, you get directly at the stock instead of hitting the flow of income, making it a much more powerful de-concentration tool than income taxes." The report pointed out that Sanders has said that the number of billionaires in the U.S. would be cut in half within 15 years under the plan.

The plan unveiled by Sanders seeks a 1 percent levy on households worth more than $32 million and proposes tax rates that would increase for wealthier people, up to 8 percent for fortunes in excess of $10 billion.

Sanders vowed to go further than Sen. Elizabeth Warren and generate more than $4 trillion over the next decade, substantially reducing billionaires’ fortunes. Billionaires would face a 62 percent average effective tax rate under Warren.

Sanders’ plan goes further because it starts on fortunes worth less, kicking in at $32 million. Warren also proposes increasing the wealth tax up to 3 percent on any net worth of more than $1 billion, while Sanders’ tax rates don’t top out until 8 percent for the richest households.

CLICK HERE FOR THE ALL-NEW FOXBUSINESS.COM

The Massachusetts senator has topped Sanders in recent polls of Democrats in Iowa and New Hampshire that show her running about even with the longtime front-runner, former Vice President Joe Biden, in those states.

Fox News' Edmund DeMarche and the Associated Press contributed to this report