McCarthy warns against Biden's government spending priorities: 'Don't play games with the debt ceiling'

House Speaker Kevin McCarthy, R-Calif., on the collapse of Silicon Valley Bank, the impending debt ceiling showdown, the "Lower Energy Cost Act" and the decision to release Jan. 6 footage to Fox News' Tucker Carlson.

House Speaker Kevin McCarthy, R-Calif., said Sunday that the best way to move forward from the Silicon Valley Bank collapse announced by the Federal Deposit Insurance Corporation (FDIC) two days earlier might call for a larger bank to make a purchase.

"I have talked with the administration, from Jay Powell and Janet Yellen. They do have the tools to handle the current situation. They do know the seriousness of this, and they're working to try to come forward with some announcement before the markets open," McCarthy told Fox News' Maria Bartiromo on "Sunday Morning Futures."

McCarthy said he hopes that announcement could come the same day, so the markets can "cool" and move forward quickly.

A customer stands outside a shuttered Silicon Valley Bank headquarters on March 10, 2023, in Santa Clara, California. (Justin Sullivan / Getty Images)

"This bank is a unique bank. They do have assets, they have an amazing clientele. It's very possible for someone to purchase this bank. I think that would be the best outcome to move forward and cool the markets." he continued.

Responding to Bartiromo's question regarding the potential for a larger institution to purchase Silicon Valley Bank, McCarthy said there's "great potential" and that the prospect of purchasing could be "attractive" to some.

"Silicon Valley Bank has a lot of assets. It's just where the capital is currently at," he said. "But it is attractive for someone to want to purchase it; it's just the timeline on where to move forward, and the [Biden] administration has tools to deal with this."

Speaker of the House Kevin McCarthy, R-Calif., conducts a news conference at the Capitol on Jan. 12, 2023. (Tom Williams / CQ-Roll Call Inc. via Getty Images)

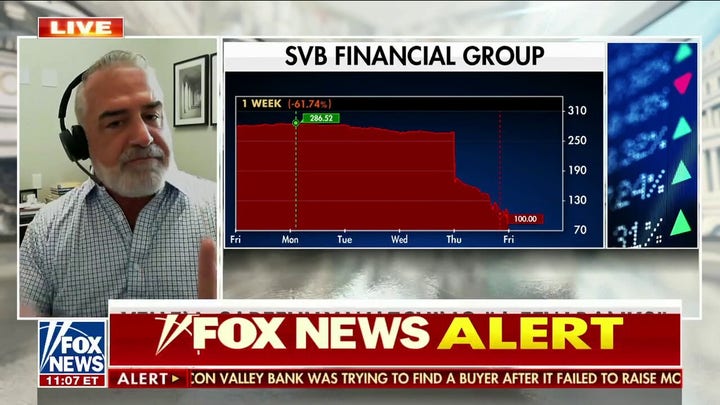

But the larger theme surrounding the bank's collapse leaves others wondering about the country's economic health under the Biden administration.

Some financial experts and business gurus, including Home Depot co-founder Bernie Marcus, allege the bank's collapse indicates tough economic times, as the collapse signals the worst U.S. financial institution failure in nearly 15 years.

"I can't wait for Biden to get on the speech again and talk about how great the economy is and how it's moving forward and getting stronger by the day. And this is an indication that whatever he says is not true," Marcus said Saturday on "Cavuto Live."

"And maybe the American people will finally wake up and understand that we're living in very tough times; that, in fact, a recession may have already started. Who knows? But it doesn't look good," he continued.

"Shark Tank" star Kevin O'Leary also criticized "weak management" for the collapse on Friday, telling Neil Cavuto that the establishment needed "institutional diversification."

Others, however, maintain that the event could have been an isolated incident.

CLICK HERE TO GET THE FOX NEWS APP

Fox News' Kayla Bailey and Joshua Comins contributed to this report.