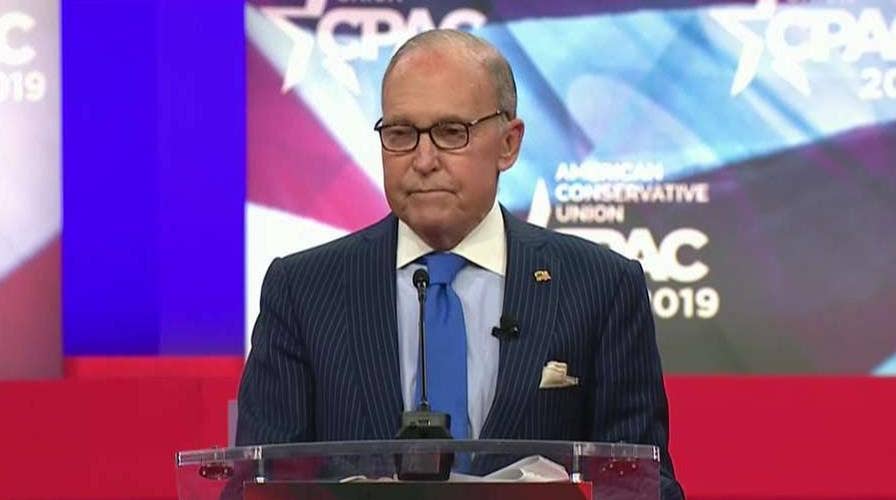

US economy hottest in the world: Larry Kudlow.

National Economic Council Director Larry Kudlow says he wants to convict socialism to ensure the Trump administration’s policies will continue to grow the U.S. economy.

Last week it was reported that the U.S. economy expanded by 2.9 percent in 2018, when measured from the 2017 annual level to the 2018 annual level. By a different metric, one that measures from the fourth quarter of 2017 to the fourth quarter of 2018, the economy expanded by 3.1 percent.

This is a growth rate unmatched since 2005, according to the Commerce Department’s Bureau of Economic Analysis’ economic activity report.

While in 2017 the U.S. economy only grew at 2.3 percent, 2018 marks a full year since the Tax Cuts and Jobs Act was passed, which was meant to incentivize capital investments and wage increases. Indeed, 2018 saw a major uptick in capital expenditures, and year-over-year real average hourly earnings rise to 2.1 percent (through January 2019) – one of the highest wage growth rates in decades.

EXPERTS PREDICTED AMERICA'S DECLINE AND EXPECTED A NEW WORLD ORDER – TRUMP HAS PROVEN THEM WRONG

The near 3 percent growth rate of 2018 flies in the face of the “secular stagnation” hypothesis (promulgated by economists like Larry Summers), which said that returning to 3 percent growth was unrealistic or impossible in the post-Great Recession era of low-interest rates and low aggregate demand. According to this theory, the U.S. economy would be paralyzed from growing beyond 1-2 percent.

However, this idea has undergone rethinking by liberal Nobel Prize-winning economists like Joseph Stiglitz, who denounced secular stagnation as an excuse for slow economic growth during the Obama years and a way to lower expectations after the administration failed to negotiate a stimulus package larger than $1 trillion in response to the Great Recession of 2008.

The truth is that corporate tax rates do matter for economic growth. A 2018 study by economists Clemens Fuest, Andreas Peichl and Sebastian Siegloch analyzing 20 years of German municipalities exploiting 6,800 tax changes found that lower corporate tax rates are associated with higher employee wage growth.

Such a natural experiment suggests that the recent uptick in real average hourly earnings (up 2.1 percent year over year) and average weekly earnings (up 2.4 percent) could very much be a result of the Tax Cuts and Jobs Act which lowered the corporate tax rate from 35 percent to 21 percent.

Similarly, several studies published in the 1990s by Kevin Hassett (now President Trump’s chair of the Council of Economic Advisers), Glenn Hubbard and Jason Cummins found that firms which received larger corporate tax windfalls following tax reforms were more likely to increase capital spending. Hence, it is no surprise that capital spending surged 7 percent in 2018 following Trump’s tax reform.

The booming 2018 GDP figure also follows a significant deregulatory agenda pursued by the administration over the past two years. The Trump administration has cut approximately 20 federal rules for every new one introduced, and new federal rules have fallen to record lows in modern history, according to the George Washington University Regulatory Studies Center.

Some have argued that President Trump has been riding on the coattails of the Obama economy. But with materially better macroeconomic figures like near 3 percent GDP growth and 2-plus percent wage growth (the latter never seen in the Obama years), even some liberal economists are capitulating.

CLICK HERE TO GET THE FOX NEWS APP

One notable one, Alan Blinder, recently wrote in the Wall Street Journal, "The tax cuts seem to have boosted growth without exciting inflation," and that his previous worry that "tax cuts might overheat an already-hot economy" increasingly "appears to have been wrong, at least so far".

With these bright figures manifesting themselves in the wake of tax reform, a new pro-growth narrative is clearly forming and the Trump administration deserves some level of credit.