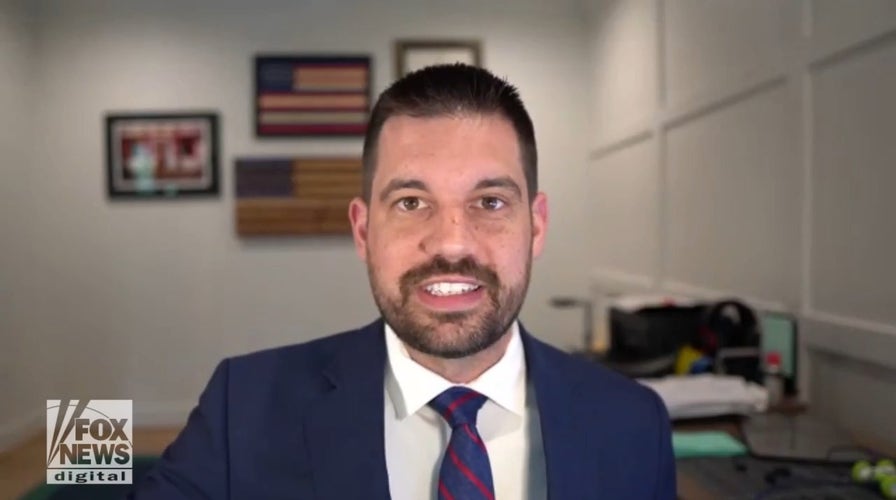

Consumers' Research executive director blasts BlackRock CEO Larry Fink over ESG

Consumers' Research executive director Will Hild says BlackRock CEO Larry Fink and BlackRock are "the poster children for ESG."

If you’re a middle-class American, chances are your retirement account quietly funds far-left priorities like climate alarmism, racial hiring quotas, and other Democratic hobby horses. That’s because of something called "ESG," or environmental, social, and corporate governance.

In simple terms, ESG is liberal activism masquerading as corporate responsibility – and it’s bad for business and your retirement account.

For several years, wealthy progressives have quietly pushed America’s most powerful firms to adopt Environmental, Social, and Governance (ESG) investing standards. These standards seek to achieve the social change in corporations that Democrats can’t pass in Congress.

Pedestrians pass the New York Stock Exchange, May 5, 2022, in Manhattan. (AP Photo/John Minchillo, File)

The "E" in ESG presses investment funds to bankroll green energy boondoggles, while the "S" and "G" push companies to hire and promote employees based on diversity, race or other non-merit based factors, and to donate to radical left-wing groups. Unfortunately, your retirement account is likely bearing the financial risk of their social experimentation.

THE WAR IN CORPORATE AMERICA BETWEEN FAITHFUL INVESTING AND WOKE INVESTING

Last year, energy was the only sector in the Standard and Poor’s 500 stock index to rise, yet ESG-aligned funds shunned fossil-fuel company investments. As a result, ESG funds underperformed the S&P 500. These ESG companies put progressivism ahead of profit and left money on the table, hurting their own investors.

Making matters worse, America’s largest ESG firms are likely violating antitrust laws by depriving the fossil fuel industry of investment. Attorneys general across the country are investigating ESG companies for antitrust violations and warning the public about the related financial risk.

Some of our nation’s largest law firms, including Latham & Watkins, Baker McKenzie, and Hogan Lovells have warned their clients of the antitrust risks posed by the ESG movement. Even President Biden’s FTC chair and assistant attorney general for the antitrust division have acknowledged that ESG companies may be violating antitrust laws.

CLICK HERE TO GET THE OPINION NEWSLETTER

Governors and state legislatures across the country have started divesting retirement and pension funds from ESG-promoting firms like BlackRock, costing those firms billions of dollars. States simply cannot risk trusting taxpayer dollars to companies exposed to antitrust lawsuits, nor can they risk exposing state-backed retirement and pension funds to liberal fantasies.

Leaders of these woke firms will eventually face the market consequences of their actions. Unfortunately, many normal Americans will suffer the consequences of choices they didn’t make and actions they didn’t approve. That isn’t fair, and it’s why we introduced the Ensuring Sound Guidance (ESG) Act.

CLICK HERE TO GET THE FOX NEWS APP

The ESG Act requires asset managers and ERISA plan sponsors to get written permission from their customers if they take non-financial interests into account when investing. Unless the customer agrees to activist investing, the ESG Act will require that investment strategies are based on sound financial practices, or in other words, maximizing returns and minimizing risk. Liberals will no longer be able to commandeer Americans’ retirement funds to accomplish their objectives.

If investors want their money backing experimental left-wing priorities, that’s one thing. But using working Americans’ retirement and college savings to pursue a political agenda without their knowledge and consent is egregious. Our legislation would preserve investor choice while limiting Americans’ financial exposure to left-wing activism.

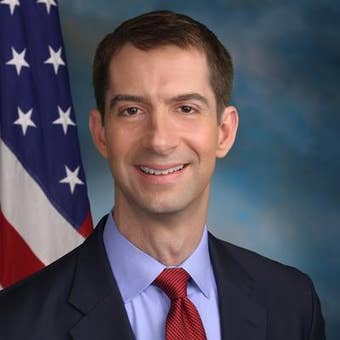

CLICK HERE TO READ MORE FROM SEN. TOM COTTON

Rep. Andy Barr has represented Kentucky as a Republican in the United States House since 2013.